Flat Panel Detector Market Summary

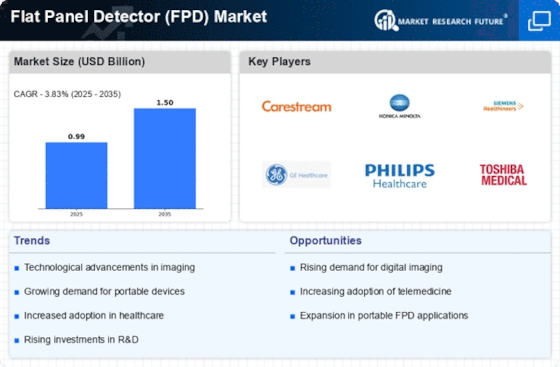

As per MRFR analysis, the Flat Panel Detector Market Size was estimated at 990.0 USD Million in 2024. The Flat Panel Detector industry is projected to grow from 1027.94 USD Million in 2025 to 1497.2 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 3.83 during the forecast period 2025 - 2035.

Key Market Trends & Highlights

The Flat Panel Detector Market is experiencing robust growth driven by technological advancements and increasing demand across various sectors.

- Technological advancements are propelling the development of more efficient and compact flat panel detectors.

- The healthcare sector is witnessing a growing demand for flat panel detectors, particularly in diagnostic imaging applications.

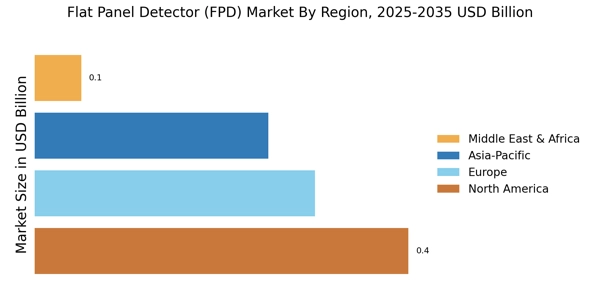

- Asia-Pacific emerges as the fastest-growing region, reflecting a surge in healthcare investments and industrial applications.

- Key market drivers include rising demand for diagnostic imaging and increased investment in healthcare infrastructure.

Market Size & Forecast

| 2024 Market Size | 990.0 (USD Million) |

| 2035 Market Size | 1497.2 (USD Million) |

| CAGR (2025 - 2035) | 3.83% |

Major Players

Carestream Health (US), Siemens Healthineers (DE), GE Healthcare (US), Philips Healthcare (NL), Canon Medical Systems (JP), Agfa-Gevaert Group (BE), Fujifilm Holdings Corporation (JP), Konica Minolta (JP), Hitachi Medical Corporation (JP)