Market Trends

Key Emerging Trends in the Fixed Tilt Solar PV Market

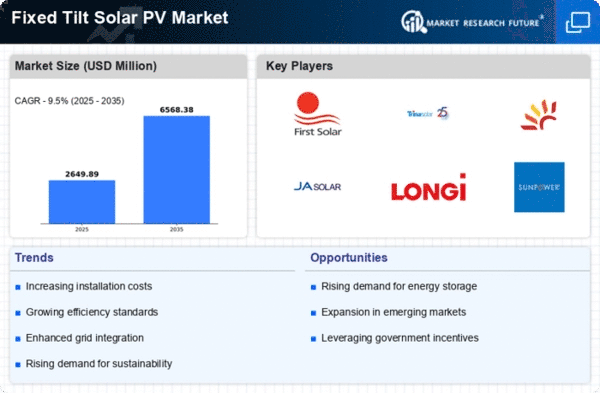

1.16 billion USD can be reached with an 11.92% CAGR from 2022 to 2030 (review period). However, it may vary due to forecast uncertainties. According to the research report published by Market Research Future (MRFR), The global fixed tilt Solar PV market is expected to grow at ~18% CAGR during the forecast period 2017–2023 owing to increasing demand for low-cost off-grid electricity generation. This is expected to drive demand for this market during the forecast period. Differentiation is central to a company's strategy when it comes to developing unique features or advanced technologies that separate its products from other brands or competitors in the industry. Market segmentation plays a key role within the competitive landscape of Fixed tilt solar PV Market. Strategic partnerships and collaborations have been witnessed in this niche sector. Companies often make alliances with project developers/engineering firms/financial institutions to strengthen their market position. Collaborative efforts may involve joint project developments, shared risk management, or co-marketing initiatives. Geographical expansion is a key strategy for companies seeking to increase their market share in the Fixed tilt solar PV Market. This could include entering new regions or countries with favorable solar conditions and growing interest in renewable energy solutions. Understanding local regulations, solar irradiance levels, and market dynamics is essential for successfully penetrating and establishing a foothold in diverse markets. Customers' tastes differ based on different locations; thus, firms need to understand these variations before developing customer-centric strategies that will help them meet their needs better. Companies that can effectively adapt to regional nuances are able to exploit emerging opportunities while at the same time ensuring their survival as global entities. Customer-centric strategies such as comprehensive project support, reliable performance guarantees, and streamlined installation processes are important for the sustainable growth of the Fixed-tilt Solar PV Market. Trust building among clients leads to not only brand loyalty but equally important recommendations, thereby influencing others' buying decisions. In conclusion, the Fixed tilt solar PV Market is a dynamic and integral part of the wider adoption of solar energy solutions. The deployment of various strategies like differentiation, cost leadership, market segmentation, collaborative partnerships, and geographical expansion, among others, helps the organizations to be strategically positioned. Hence, they gain a competitive advantage. Consequently, as solar technology advances further, energy requirements shift while demand for sustainability escalates; companies operating within this domain have no alternative but to remain adaptable so that they can refine their approaches continually, thus remaining competitive under the ever-changing landscape emanating from the solar sector growth.

Leave a Comment