Market Share

Fixed Tilt Solar PV Market Share Analysis

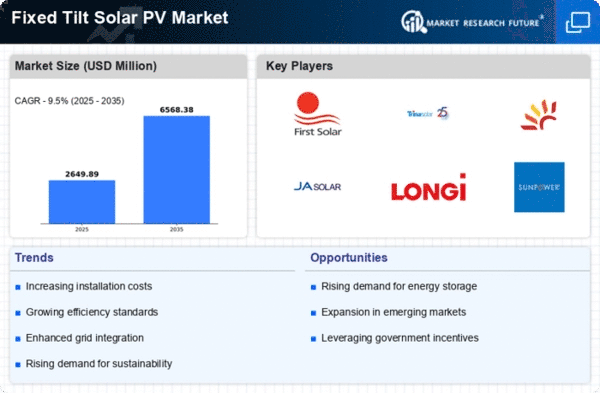

The major factors driving the growth of the global Fixed tilt solar PV market are the growing demand for electricity generation from solar energy and increasing government initiatives to adopt solar energy for electricity generation. The Fixed tilt solar PV market is undergoing notable trends reflective of the evolving dynamics within the solar energy sector. A significant trend is the continued expansion of utility-scale fixed-tilt solar projects. These projects, characterized by stationary solar panels set at a fixed angle, are gaining popularity due to their simplicity, cost-effectiveness, and suitability for large-scale installations. The trend towards utility-scale fixed-tilt solar arrays is driven by the growing demand for clean and renewable energy, with utilities and independent power producers recognizing the benefits of deploying solar projects with fixed-tilt configurations. Technological developments are vital in shaping the Fixed tilt solar PV market. This is perpetuated by ongoing research and development efforts aimed at enhancing the efficiency and performance of solar panels and inverters, as well as the balance of system components used for fixed-tilt installations. In fixed-tilt installations, the market is shifting towards bifacial solar modules. Since they can receive sunlight from both sides, bifacial modules enable more energy to be tapped. Thus, this trend aims to increase energy yields and enhance the overall efficiency of fixed-tilt solar arrays. The integration of bifacial technology into fixed-tilt projects offers a promising opportunity for further improving utility-scale solar installation performance. The Fixed tilt solar PV market has its trends shaped by sustainability and environmental considerations. Another trending factor in the market is how land use can be optimized, specifically about fixed tilt solar installations. Developers are increasingly looking for ways to maximize energy output while minimizing land requirements in their solar projects. Grid integration is another key trend that shapes the Fixed tilt solar PV industry. As more photovoltaic (PV) power plants are connected to electricity grids, issues regarding interconnection become germane to developers and regulators alike across numerous jurisdictions as there are no international standards currently covering these aspects fully, yet which could provide a basis for such consideration or definition, even if desired. The nature of government incentives and policies is also significant in understanding the determination of the fixed-tilt solar PV market. Currently, governments in some areas provide financial incentives, i.e., grants, tax credits, or regulatory frameworks supporting solar projects, leading to growth prospects of using fixed-tilted systems. In fact, new market opportunities have emerged, including better asset performance and management provided through advanced monitoring and control systems. The Fixed tilt solar PV markets, therefore, consist of dynamic trends driven by utility-scale expansion, technology improvements/bifacial, sustainable practices/land optimization/integrated grids/market dynamics/government incentives, plus enhanced asset performances.

Leave a Comment