Market Growth Projections

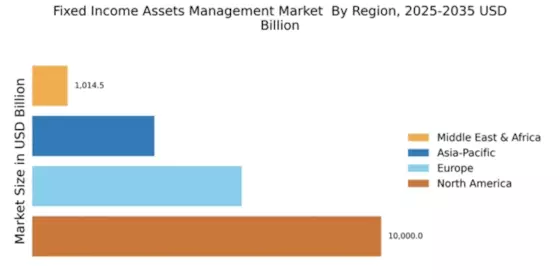

The Global Fixed Income Assets Management Industry is poised for substantial growth, with projections indicating a compound annual growth rate (CAGR) of 7.84% from 2025 to 2035. This growth trajectory reflects increasing investor interest in fixed income products as a means of capital preservation and income generation. The market's expansion is likely fueled by demographic shifts, such as an aging population requiring stable income sources. As the industry evolves, asset managers must innovate and adapt to meet the changing needs of investors, ensuring their relevance in the competitive landscape of the Global Fixed Income Assets Management Industry.

Global Economic Conditions

Global economic conditions serve as a fundamental driver of the Global Fixed Income Assets Management Industry. Economic growth, inflation rates, and geopolitical events influence investor sentiment and asset allocation decisions. In a robust economic environment, investors may diversify into equities, while economic downturns typically lead to a flight to safety, favoring fixed income assets. As the market is projected to grow to 541.32 USD Billion by 2035, the interplay between economic indicators and fixed income investments will remain critical in shaping the future landscape of the Global Fixed Income Assets Management Industry.

Interest Rate Fluctuations

Interest rate fluctuations play a crucial role in shaping the Global Fixed Income Assets Management Industry. As central banks adjust rates to manage inflation and economic growth, the attractiveness of fixed income investments varies. For instance, rising interest rates may lead to declining bond prices, prompting investors to reassess their strategies. Conversely, lower rates can enhance the appeal of fixed income securities, as they provide a reliable income stream. This dynamic environment compels asset managers to adapt their portfolios accordingly, influencing the overall growth trajectory of the Global Fixed Income Assets Management Industry.

Regulatory Changes and Compliance

Regulatory changes and compliance requirements are pivotal factors influencing the Global Fixed Income Assets Management Industry. Governments and regulatory bodies continuously update frameworks to enhance transparency and protect investors. These regulations may impose stricter reporting standards and risk management protocols, compelling asset managers to adapt their operations. While compliance can be resource-intensive, it also fosters investor confidence, thereby attracting more capital into fixed income markets. Consequently, the evolving regulatory landscape shapes the strategies employed by firms within the Global Fixed Income Assets Management Industry.

Rising Demand for Fixed Income Securities

The Global Fixed Income Assets Management Industry experiences a notable increase in demand for fixed income securities, driven by investors seeking stable returns amidst market volatility. In 2024, the market is valued at approximately 235.94 USD Billion, reflecting a growing preference for bonds and other fixed income instruments. This trend is particularly evident among institutional investors, such as pension funds and insurance companies, which allocate significant portions of their portfolios to fixed income assets. The stability offered by these securities is appealing, especially in uncertain economic climates, thereby propelling the growth of the Global Fixed Income Assets Management Industry.

Technological Advancements in Asset Management

Technological advancements significantly impact the Global Fixed Income Assets Management Industry, enhancing efficiency and decision-making processes. Innovations such as artificial intelligence and machine learning enable asset managers to analyze vast datasets, identify trends, and optimize portfolio allocations. These technologies facilitate better risk management and improve client service through personalized investment strategies. As firms increasingly adopt these tools, they position themselves competitively within the Global Fixed Income Assets Management Industry, potentially leading to increased market share and profitability.