Market Trends

Key Emerging Trends in the Fixed Fire Fighting Systems FFFS Market

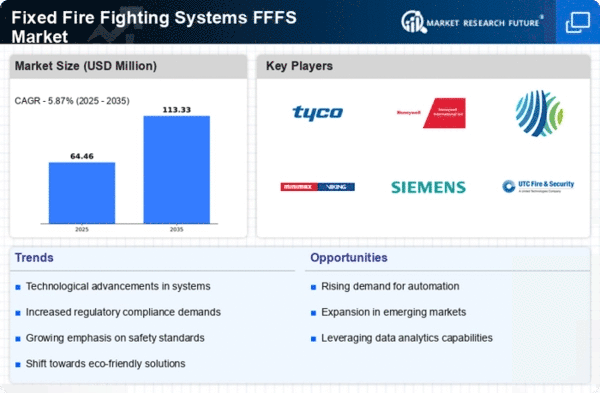

Market trends for the FFFS reveals a shift from cost and efficiency concerns to an emphasis on safety, risk minimization in different industries. FFFS, which is an abbreviation for systems such as sprinkler systems and gas-based suppression system and foam-based system are very important fire fighting tools that keep fires at bay in commercial, industrial, or residential setting. Among the major trends in the FFFS market are technology adoption that is broadly taking new level path. The integration and intelligence of the future food facilities systems is due to the emergence of smart building solutions that enable these FFFSs. With such Interconnection, it is possible to coordinate the operation of these systems with building management systems so that they can provide real-time monitoring and control. This connectivity ensures the faster of response time, greater efficiency, and permits to accumulate data for analytics all of which increases overall fire safety system. The other trend is toward a more environment-friendly form of fire suppressant. The major part of classical methods was based on chemically contaminated substances with environmental issues that required shifting to resource-saving substitutes. The clean agents such as inert gases and water mist systems that do not burn the environment are abounding increasingly within the industry, while still another application of gas suppression is being used to eliminate fires effectively. This is consistent with the nature of global pursuit for sustainability, and advancements in green technologies. The pressure for FFFS use is also being propelled by strict safety considerations that are enforced and regulated by the government bodies concerned. With authorities around the globe cracking down on the protocols related to safety, industries have no choice but go all out in investing in fire protection system. This tendency is clearly noticeable in industries, such as manufacturing, oil and gas systems, and medicine because a fire may cause crucial consequences. Apart from the regulatory compliance, increase in industrialization and mobilization of infrastructure play a crucial role to claim the market share FFFS. With the further increasing number of companies that grow and create brand new workplaces, reliable fire protection is you should fulfill. This has resulted to more investments in fixed fire fighting systems for the sake of protecting assets, property, and personnel apart from ensuring continuity of operations. The market is also undergoing a trend towards the play of personalized solutions. Companies are becoming aware of the necessity of making fire protection systems as claim after a client requires. This relentless evolution has pushed the innovation of manufactures to create modular and flexible FFFS capable of adaptation as per industry, facility layout, type of materials stored or processed including their physical properties.

Leave a Comment