Market Trends

Key Emerging Trends in the Fire Protection Systems Market

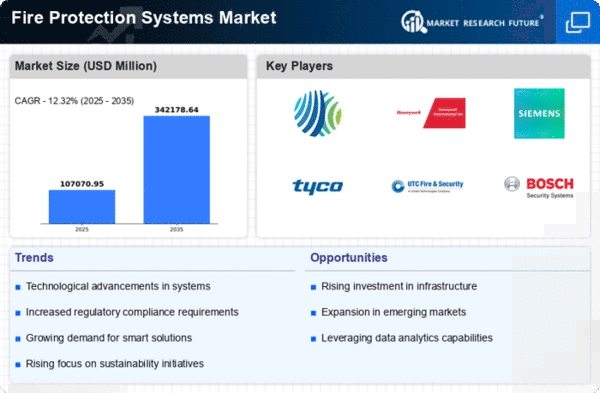

Huge advancements in the fire protection system market are reshaping the business and affecting the choices of the two purchasers and organizations. A perceptible example is the developing execution of complex innovations inside fire insurance frameworks. The functional cycles of these frameworks have been essentially changed by the converge of Computerized reasoning (simulated intelligence), the Web of Things (IoT), and information investigation. Astute fire recognition and caution frameworks, which are outfitted with availability functionalities and sensors, empower brief reactions to potential fire episodes through constant checking and early admonition abilities. In addition to increasing the effectiveness of fire prevention measures, this development coincides with the global shift toward intelligent and interconnected technologies.

One more critical advancement in the market is the multiplication of fire protection systems that are good for the climate. The need for extinguishing systems that make use of materials and agents that are better for the environment has grown as ecological issues have become more widely acknowledged. Fire suppression products that effectively reduce environmental impact without sacrificing functionality are becoming increasingly important to manufacturers. This pattern is reliable with administrative systems and worldwide maintainability goals that urge organizations to take on economical practices.

Furthermore, there is a pattern toward coordinated fire insurance arrangements available. Both end-clients and organizations are presently looking for sweeping fire wellbeing frameworks that incorporate identification, concealment, and clearing abilities. The organization of fire insurance measures is smoothed out by incorporated frameworks, which give a concentrated and brought together way to deal with wellbeing. Large industrial and commercial complexes, where a comprehensive fire protection strategy is essential, are particularly susceptible to this phenomenon.

In the market for fire protection systems, adaptability and customization have emerged as significant trends. Because of the way that ventures and associations have differing needs founded on their specific designs and activities, the interest for tweaked fire insurance arrangements is expanding. Manufacturers are reacting to this trend by offering compliant systems that can be adapted to meet the specific requirements of various environments. This method improves the efficiency of fire safety protocols by focusing on specific challenges faced by various industries.

There is as of now a remarkable rise in the market's interest for remote fire security frameworks. Remote choices are uprooting conventional wired frameworks because of their improved adaptability concerning establishment and support. Retrofitting remote frameworks into previous designs is a breeze, subsequently relieving the complexities that are innate in regular wired setups. This trend is especially relevant in sectors like small businesses and residential structures where prompt and efficient installation is crucial.

As well as affecting business sector patterns, globalization has expanded the significance put on consistence and normalization. The rising globalization of organizations requires the execution of fire security frameworks that adjust to worldwide guidelines and norms. To ensure the materialness and consistence of their items across different business sectors, makers are chasing after similarity with global security principles.

Leave a Comment