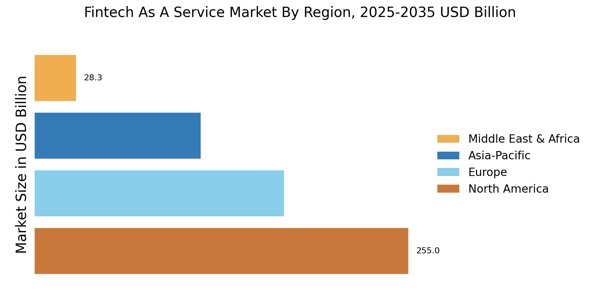

North America : Innovation and Leadership Hub

North America is the largest market for Fintech as a Service, holding approximately 45% of the global market share. North America leads the fintech as a service market, supported by strong investment, mature infrastructure, and favorable regulations, significantly contributing to fintech annual revenue and fintech industry growth. The region's growth is driven by a robust technological infrastructure, increasing demand for digital payment solutions, and favorable regulatory frameworks. The U.S. leads this market, followed closely by Canada, which contributes around 15% to the overall market. Regulatory support for innovation, such as the Office of the Comptroller of the Currency's initiatives, further catalyzes growth. The competitive landscape is characterized by major players like Stripe, PayPal, and Square, which dominate the market with their innovative solutions. The presence of numerous startups and established firms fosters a dynamic environment, encouraging continuous advancements in technology. The U.S. is home to a significant number of fintech companies, making it a global leader in this sector, while Canada is emerging as a strong contender with its supportive policies and growing investment in fintech.

Europe : Emerging Fintech Powerhouse

Europe is rapidly becoming a significant player in the Fintech as a Service market, holding approximately 30% of the global market share. Europe continues to strengthen its position within the global fintech market, driven by regulatory support and growing fintech market research initiatives. The region benefits from a diverse financial ecosystem, increasing consumer demand for digital services, and strong regulatory support, particularly from the European Union's PSD2 directive, which encourages competition and innovation. The UK and Germany are the largest markets, contributing around 12% and 8% respectively, with a focus on enhancing digital payment solutions. Leading countries like the UK, Germany, and France are at the forefront of this growth, with a competitive landscape featuring key players such as Adyen and Solarisbank. The presence of numerous fintech startups and established firms fosters innovation, while regulatory frameworks ensure consumer protection and market stability. The European market is characterized by a collaborative approach between traditional banks and fintech companies, enhancing service offerings and customer experience.

Asia-Pacific : Rapid Growth and Adoption

Asia-Pacific is witnessing a rapid transformation in the Fintech as a Service market, holding approximately 20% of the global market share. Asia-Pacific is experiencing rapid expansion in the fintech as a service market, supported by digital adoption and strong fintech stats across emerging economies. The region's growth is driven by increasing smartphone penetration, a large unbanked population, and supportive government initiatives aimed at promoting digital finance. Countries like China and India are leading this growth, with China accounting for about 10% of the market, driven by its vast digital payment ecosystem and regulatory support for fintech innovation. The competitive landscape is vibrant, with key players like Rapyd and various local startups emerging to meet the growing demand for digital financial services. The region's diverse market dynamics, coupled with a strong focus on technology adoption, are reshaping the financial services landscape. Governments are actively promoting fintech through favorable regulations, which further accelerates market growth and enhances consumer access to financial services.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa region is gradually establishing itself in the Fintech as a Service market, holding approximately 5% of the global market share. The Middle East and Africa region presents emerging opportunities within the fintech as a service market, supported by financial inclusion initiatives and expanding fintech industry statistics. The growth is primarily driven by increasing mobile penetration, a young population, and a rising demand for financial inclusion. Countries like South Africa and Nigeria are leading the charge, with South Africa contributing around 3% to the market, supported by government initiatives aimed at enhancing digital financial services. The competitive landscape is evolving, with local players and international firms entering the market to capitalize on the growing demand. Key players like Finastra are making significant inroads, while numerous startups are emerging to address specific regional needs. The region's unique challenges, such as regulatory hurdles and infrastructure gaps, are being addressed through innovative solutions, paving the way for a more inclusive financial ecosystem.