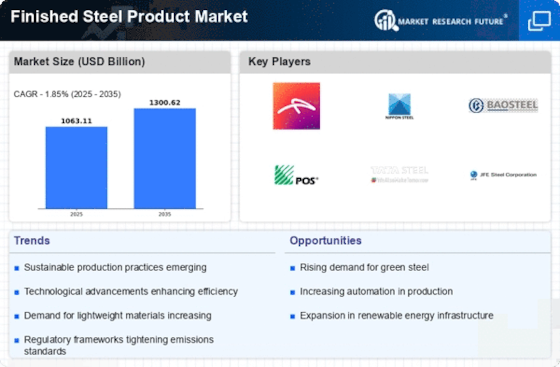

Energy Sector Investments

Investments in renewable energy infrastructure are likely to bolster the Finished Steel Product Market. The transition towards sustainable energy sources, such as wind and solar power, necessitates the use of finished steel products for constructing wind turbines, solar panels, and related infrastructure. Recent data indicates that the renewable energy sector is expected to grow at a compound annual growth rate of over 10% in the coming years. This growth suggests a corresponding increase in demand for finished steel products, as these materials are essential for the durability and efficiency of renewable energy installations, thereby driving market expansion.

Technological Innovations

Technological advancements in steel production and processing are poised to influence the Finished Steel Product Market significantly. Innovations such as automation, artificial intelligence, and advanced manufacturing techniques are enhancing production efficiency and product quality. These developments not only reduce costs but also enable the production of specialized finished steel products that meet specific industry requirements. As manufacturers adopt these technologies, the market is likely to witness an increase in the variety and quality of finished steel products available, catering to diverse applications across various sectors, thus driving overall market growth.

Automotive Industry Growth

The resurgence of the automotive industry is another significant driver for the Finished Steel Product Market. As vehicle production ramps up, the demand for high-strength steel products is expected to rise. In recent years, the automotive sector has been shifting towards lighter materials to improve fuel efficiency, yet high-strength steel remains a preferred choice due to its cost-effectiveness and safety features. Reports suggest that the automotive industry accounts for nearly 20% of the total finished steel consumption. This trend indicates that as automotive production increases, so too will the demand for finished steel products, thereby positively impacting market growth.

Infrastructure Development

The ongoing expansion of infrastructure projects worldwide appears to be a primary driver for the Finished Steel Product Market. Governments and private sectors are investing heavily in roads, bridges, and buildings, which necessitates a substantial amount of finished steel products. For instance, the construction sector is projected to consume approximately 50% of the total finished steel production. This trend indicates a robust demand for steel products, as infrastructure development is often seen as a catalyst for economic growth. Furthermore, the increasing urbanization rates in various regions are likely to further amplify the need for durable and high-quality finished steel products, thereby enhancing market dynamics.

Regulatory Frameworks and Standards

The establishment of stringent regulatory frameworks and quality standards is becoming increasingly relevant for the Finished Steel Product Market. Governments are implementing regulations aimed at ensuring the safety and sustainability of construction materials, which includes finished steel products. Compliance with these standards often necessitates the use of higher-quality materials, thereby driving demand for premium finished steel products. Additionally, as industries strive to meet environmental regulations, the shift towards eco-friendly production methods may further influence market dynamics. This regulatory landscape suggests that companies focusing on compliance and quality will likely gain a competitive edge in the finished steel market.