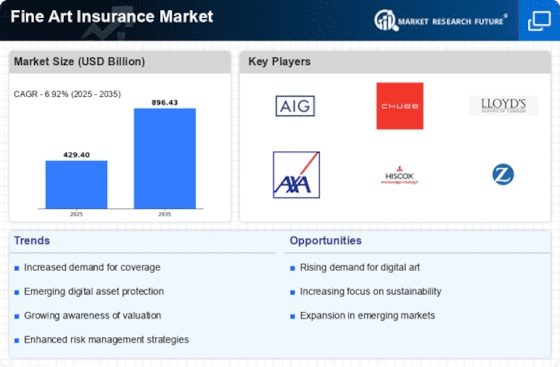

Rising Value of Fine Art Assets

The increasing value of fine art assets is a primary driver for the Fine Art Insurance Market. As art pieces appreciate over time, collectors and investors are more inclined to seek insurance coverage to protect their investments. According to recent estimates, the art market has seen a consistent annual growth rate of approximately 10%, leading to higher valuations for artworks. This trend suggests that as the financial stakes rise, the demand for specialized insurance products tailored to fine art will likely increase. Insurers are responding by developing policies that cater specifically to the unique needs of art collectors, thereby enhancing the overall market for fine art insurance.

Expansion of Art Investment Funds

The proliferation of art investment funds is contributing to the growth of the Fine Art Insurance Market. These funds, which pool resources from multiple investors to acquire high-value artworks, necessitate robust insurance coverage to protect their collective investments. As the art investment landscape evolves, the need for specialized insurance products that cater to the unique requirements of these funds becomes increasingly apparent. Data suggests that the number of art investment funds has risen significantly, leading to a corresponding increase in demand for fine art insurance. This trend indicates a shift in how art is perceived as an investment, further driving the market.

Growing Awareness of Risk Management

There is a notable increase in awareness regarding risk management among art collectors and institutions, which serves as a significant driver for the Fine Art Insurance Market. Collectors are becoming more cognizant of the potential risks associated with art ownership, including theft, damage, and loss. This heightened awareness is prompting individuals and organizations to seek comprehensive insurance solutions to mitigate these risks. Reports indicate that the demand for fine art insurance has surged, with a marked increase in policy inquiries and purchases. As collectors recognize the importance of safeguarding their assets, the market for fine art insurance is expected to expand further.

Increased Participation in Art Auctions

The rising participation in art auctions is a notable driver for the Fine Art Insurance Market. As more individuals and institutions engage in the auction process, the need for insurance coverage becomes paramount. Auction houses often require sellers to have insurance in place to protect artworks during the auction process. Recent statistics reveal that auction sales have reached record highs, with a substantial increase in the number of bidders. This trend suggests that as the auction market flourishes, the demand for fine art insurance will likely follow suit, as participants seek to safeguard their investments during these high-stakes transactions.

Technological Advancements in Art Valuation

Technological advancements in art valuation are influencing the Fine Art Insurance Market. Innovations such as blockchain technology and artificial intelligence are enhancing the accuracy and efficiency of art appraisals. These technologies provide collectors and insurers with reliable data regarding the value and provenance of artworks, which is crucial for determining appropriate insurance coverage. As the market embraces these advancements, the demand for fine art insurance is expected to grow, as accurate valuations lead to more informed insurance decisions. This trend indicates a shift towards a more data-driven approach in the fine art insurance sector, potentially attracting a broader range of clients.