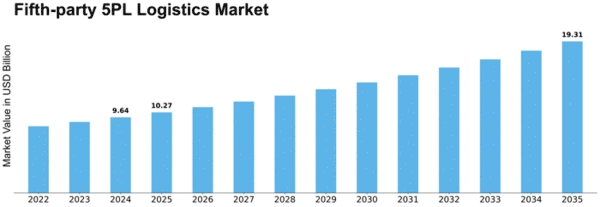

Fifth Party 5pl Logistics Size

Fifth-party 5PL Logistics Market Growth Projections and Opportunities

5PL logistics is an industry in motion, subject to various market forces that determine the direction of its growth and evolution. One of the main factors driving 5PL market development is global trade and e-commerce expansion which has witnessed a remarkable increase in the need for efficient and sophisticated 5PL services that provide businesses with modernized solutions. The size of the fifth-party (5PL) Logistics Market was valued at USD 8.5 billion in 2022. The fifth-party (5PL) logistics market is expected to grow from USD 9.05 Billion in 2023 to USD 14.98 billion by 2032, at a CAGR of about 6.5%.

Technological advancements also stand out as a pivotal market factor for 5PL logistics. The application of new technologies including AI, Blockchain, IoT among others has redefined how logistics operations are conducted globally today by increasing visibility, traceability and overall supply chain efficiency thus making the role played by these services indispensable especially for organizations focusing on lean and agile logistic solutions.

Another significant factor contributing to the growth of the 5PL market is the increasing focus on sustainability and environmental consciousness. As companies align their strategies with eco-friendly practices, they require greener supply chains hence forcing their outsourced logistics partners to adopt more sustainable methods such as optimizing transportation routes, cutting down carbon emissions or using environmentally friendly packaging materials among others. This is not only meeting demands for social responsibility from green companies but also addressing global attempts to minimize carbon footprint during logistical operations.

Moreover, one major reason affecting how big the market for fifth party logistics service providers gets is due to growing complexities within supply chain networks.Globalizing companies have encountered complex processes across multiple layers requiring specialized third-party service providers who can manage an entire supply chain effectively.Fulfilling requirements encompassing sourcing through distribution allows businesses concentrate internally on what they do best.

Furthermore, customer expectations play a crucial role in shaping the 5PL market. The dynamics of the modern consumer that is used to instant gratification and high expectations are making businesses look for logistics partners that can deliver fast, reliable as well as transparent services. This has been observed to distinguish 5PL from its competitors hence being customer centric by offering services such as real-time tracking, precise shipment estimates and quick feedback when needed.

Leave a Comment