Fiber Drum Size

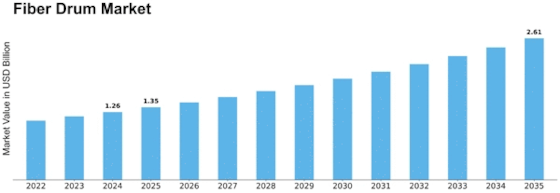

Fiber Drum Market Growth Projections and Opportunities

The fiber drum market is influenced by several key market factors that shape its dynamics and growth trajectory. One significant factor is the increasing demand for eco-friendly and sustainable packaging solutions across various industries such as chemicals, pharmaceuticals, food and beverages, and cosmetics. Fiber drums, also known as cardboard drums, offer advantages such as biodegradability, recyclability, and renewable sourcing, making them an attractive option for companies seeking to reduce their environmental footprint. With growing awareness of environmental issues and regulations aimed at reducing plastic waste, the demand for fiber drums as an alternative packaging solution continues to rise. This trend is driven by consumer preferences for environmentally responsible products and corporate sustainability initiatives aimed at minimizing environmental impact.

Moreover, technological advancements and innovations play a crucial role in shaping market dynamics within the fiber drum industry. Manufacturers are investing in research and development to improve the design, performance, and functionality of fiber drums. Advanced manufacturing processes such as spiral winding and compression molding enable the production of fiber drums with precise dimensions, consistent quality, and enhanced structural integrity. Additionally, innovations in material science and fiberboard technology allow for the development of specialty fibers and coatings that enhance the moisture resistance, strength, and durability of fiber drums. These technological advancements drive product innovation, enabling manufacturers to offer a diverse range of fiber drum solutions tailored to specific industry requirements and application needs.

Furthermore, regulatory requirements and quality standards influence market factors in the fiber drum industry. The transportation and storage of hazardous and non-hazardous materials are subject to stringent regulations governing packaging, labeling, and handling practices to ensure safety and compliance. Fiber drums must meet regulatory standards such as UN/DOT (United Nations/Department of Transportation) certification, FDA (Food and Drug Administration) approval, and ISTA (International Safe Transit Association) testing to be suitable for use with specific types of products. Additionally, manufacturers of fiber drums must adhere to industry standards such as ASTM (American Society for Testing and Materials) specifications and ISO (International Organization for Standardization) certifications to ensure product quality and performance. These regulatory requirements create barriers to entry for new players and reinforce the importance of established manufacturers with a track record of compliance and quality assurance. Fiber drums for their portability and easy handling can easily be adopted with maritime containers and trucks. The drum is lightweight and is ideal for the transportation and storage of liquid products. These factors increase the demand for fiber drum market analysis. Fiber drum is 100% recyclable and is the major driver of the fiber drum industry.

Moreover, market factors such as raw material prices, supply chain disruptions, and economic conditions influence the pricing and availability of fiber drums. Fluctuations in the prices of paper pulp, which is used as the primary raw material for manufacturing fiber drums, directly impact the cost of fiber drum production. Supply chain disruptions, such as natural disasters, geopolitical tensions, and transportation bottlenecks, can lead to shortages of raw materials and delays in production, affecting the availability of fiber drums in the market. Additionally, economic factors such as GDP growth, industrial output, and consumer spending influence demand for packaging materials and, consequently, the fiber drum market. During periods of economic expansion, there is typically increased demand for packaged goods and industrial products, driving the growth of the fiber drum market.

Furthermore, changing consumer preferences and industry trends influence market dynamics within the fiber drum industry. Consumers are increasingly seeking packaging solutions that offer sustainability, durability, and ease of use. Fiber drums are favored for their eco-friendly properties, which appeal to environmentally conscious consumers and businesses seeking to reduce their carbon footprint. Additionally, industry trends such as supply chain optimization, lean manufacturing, and just-in-time inventory management drive the adoption of fiber drums for bulk material handling and storage applications. As industries evolve and adapt to changing market dynamics, the demand for fiber drums continues to grow, creating opportunities for manufacturers to innovate and expand their product offerings to meet evolving customer needs.

Leave a Comment