Growth in Residential and Commercial Construction

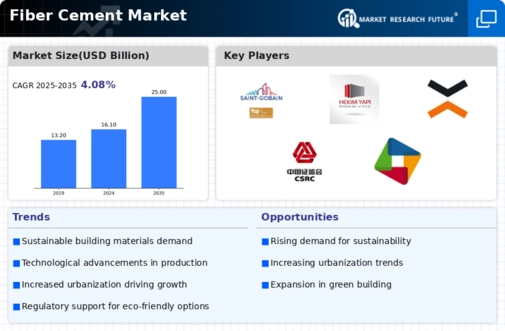

The Global Fiber Cement Market Industry is significantly influenced by the expansion of residential and commercial construction activities. As urbanization accelerates, the demand for durable and aesthetically pleasing building materials rises. Fiber cement, known for its versatility and resilience, is increasingly utilized in both sectors. The market is expected to grow to 25 USD Billion by 2035, driven by new housing projects and commercial developments. For instance, in regions experiencing rapid urban growth, fiber cement is favored for its ability to withstand harsh weather conditions while providing a modern appearance. This growth trajectory underscores the material's integral role in contemporary construction.

Increased Awareness of Fire Resistance Properties

The Global Fiber Cement Market Industry benefits from heightened awareness regarding fire resistance properties of building materials. Fiber cement is recognized for its non-combustible nature, making it a preferred choice in fire-prone areas. As safety regulations become more stringent, builders are increasingly opting for materials that enhance fire safety in residential and commercial structures. This trend is particularly evident in regions prone to wildfires, where fiber cement siding and roofing are gaining popularity. The emphasis on safety and compliance with building codes is likely to bolster the market, as consumers prioritize fire-resistant materials in their construction projects.

Rising Demand for Sustainable Construction Materials

The Global Fiber Cement Market Industry experiences a notable surge in demand for sustainable construction materials. As environmental concerns grow, builders and architects increasingly favor fiber cement due to its eco-friendly properties. This material is composed of natural fibers and cement, which reduces the environmental footprint compared to traditional materials. The market is projected to reach 16.1 USD Billion in 2024, reflecting a shift towards sustainable practices in construction. Countries are implementing stricter regulations on building materials, further driving the adoption of fiber cement. This trend indicates a long-term commitment to sustainability, positioning fiber cement as a preferred choice in the global construction landscape.

Technological Advancements in Fiber Cement Production

Technological innovations play a crucial role in shaping the Global Fiber Cement Market Industry. Advances in manufacturing processes enhance the quality and performance of fiber cement demand, making them more appealing to consumers. Innovations such as improved mixing techniques and the introduction of advanced additives contribute to the material's durability and aesthetic qualities. These advancements not only reduce production costs but also increase efficiency, allowing manufacturers to meet the growing demand. As a result, the market is projected to grow at a CAGR of 4.08% from 2025 to 2035. This trend indicates that ongoing research and development will continue to drive the market forward.