Changing Societal Norms

Societal changes regarding family planning and childbearing are impacting the Fertility Testing Market. As more individuals prioritize career development and personal goals, the average age of first-time parents has increased. This trend has led to a greater awareness of fertility issues, prompting individuals to seek testing options earlier. The Fertility Testing Market is adapting to these shifts by offering a range of products that cater to different age groups and lifestyles. As societal norms continue to evolve, the demand for fertility testing solutions is expected to rise, reflecting the changing dynamics of family planning.

Rising Infertility Rates

The increasing prevalence of infertility is a primary driver for the Fertility Testing Market. Recent statistics indicate that approximately 15% of couples experience difficulties in conceiving, which has led to a heightened demand for fertility testing solutions. This trend is particularly evident in urban areas where lifestyle factors, such as delayed childbearing and increased stress levels, contribute to reproductive challenges. As more individuals seek to understand their fertility status, the market for testing products and services is expected to expand. The Fertility Testing Market is likely to see innovations in testing methods, catering to the needs of a growing demographic concerned about reproductive health.

Regulatory Support and Initiatives

Regulatory frameworks and initiatives aimed at promoting reproductive health are driving the Fertility Testing Market. Governments and health organizations are increasingly recognizing the importance of fertility awareness and are implementing policies to support access to testing services. This includes funding for educational programs and subsidies for fertility testing products. Such initiatives not only enhance public awareness but also encourage individuals to seek testing services. As regulatory support strengthens, the Fertility Testing Market is likely to experience growth, with increased accessibility to testing solutions that empower individuals to make informed decisions about their reproductive health.

Technological Innovations in Testing

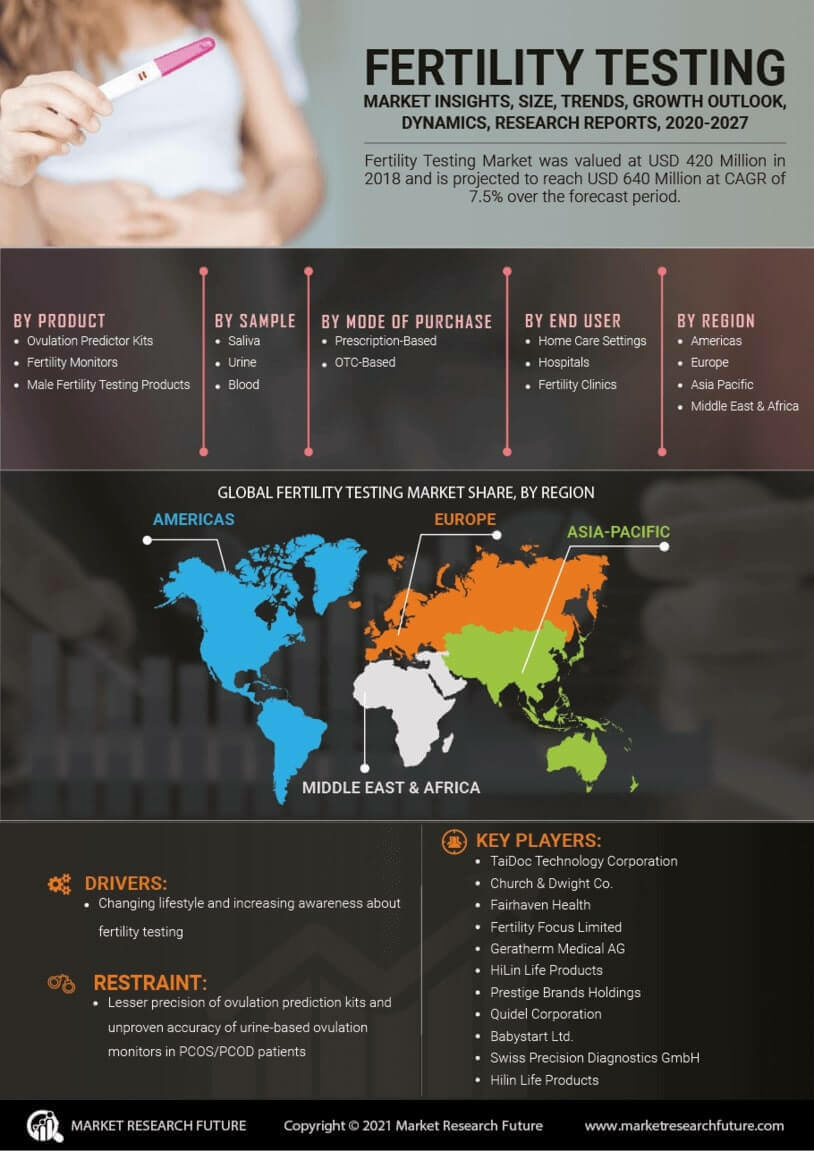

Technological advancements play a crucial role in shaping the Fertility Testing Market. The introduction of sophisticated testing devices, such as ovulation prediction kits and hormone level monitors, has revolutionized how individuals assess their fertility. These innovations not only enhance accuracy but also improve user experience, making testing more accessible. For instance, the integration of mobile applications with testing devices allows users to track their fertility cycles effectively. As technology continues to evolve, the Fertility Testing Market is poised for growth, with new products that offer real-time data and personalized insights into reproductive health.

Increased Focus on Preventive Healthcare

The growing emphasis on preventive healthcare is influencing the Fertility Testing Market. Individuals are increasingly proactive about their health, seeking early detection and intervention for potential fertility issues. This shift is reflected in the rising sales of fertility testing kits, which empower consumers to take charge of their reproductive health. According to recent data, the market for at-home fertility tests is projected to grow significantly, driven by consumer demand for convenience and privacy. As awareness of reproductive health expands, the Fertility Testing Market is likely to benefit from a surge in demand for preventive testing solutions.