Market Trends

Key Emerging Trends in the Feed Preservatives Market

To keep animal fats and oils from oxidizing during manufacture, kibble and dry pet food need preservatives or antioxidants. Feed preservatives prevent food deterioration and increase shelf life in animal foods.

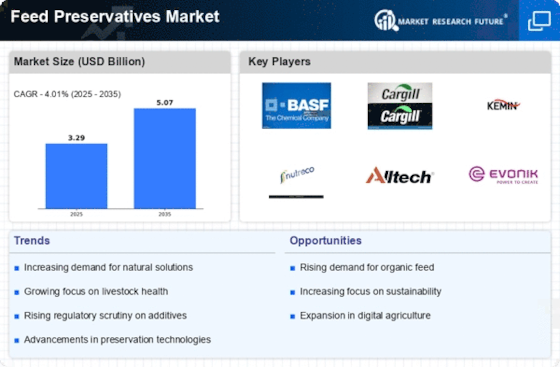

The Feed Preservatives market is dynamic and competitive, and strong market share positioning tactics are needed to preserve animal feed and prevent spoiling. Feed preservatives keep animal feeds nutritious, promoting livestock health and production. Companies in this industry use several strategies to increase market share and differentiate.

A key approach is product innovation and formulation improvement. Companies spend a lot of money developing feed preservatives that prevent spoiling and maintain feed quality. Companies may offer feed preservatives that increase shelf life and fulfill growing demand for sustainable and safe solutions by using the latest preservative technologies, such as natural antioxidants or antibacterial agents. Differentiated, high-performance products improve market share by attracting more customers.

The Feed Preservatives business also uses market segmentation. Companies separate the market by animal species, feed composition, and storage conditions to meet livestock producers' varying demands and feed kinds. Companies can target particular markets by customizing feed preservatives for each sector. This strategy meets client needs and optimizes marketing for maximum impact.

Strategic alliances are important in Feed Preservatives. Companies work with animal nutritionists, feed makers, and research institutes to improve feed preservation, nutritional stability, and microbial management. Innovative feed preservative formulations and research-backed insights can result from collaboration. Companies gain market share and meet current animal husbandry needs by combining expertise.

Feed Preservatives companies may expand geographically to gain market share. Companies intentionally target countries with significant animal output, varied feed manufacturing, and expanding feed preservation awareness. Adapting goods to regional feed types, storage conditions, and industry rules helps firms meet particular difficulties in varied markets and increase market share.

Some Feed Preservatives firms use cost competitiveness to obtain an edge. Competitive feed preservative pricing can be achieved by improving production processes, acquiring raw ingredients, and simplifying distribution networks. Cost-effective solutions attract more customers, especially in places where cost influences buying decisions. This method increases market share by making items more accessible and appealing to more people."

Leave a Comment