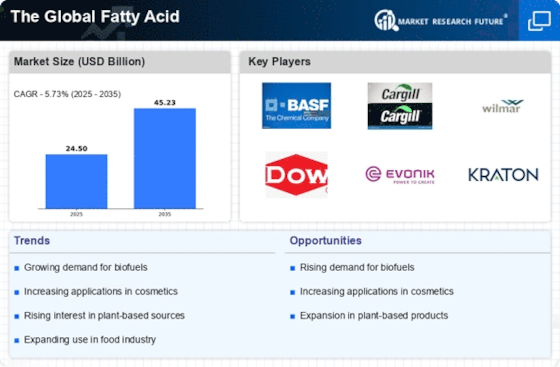

Rising Demand for Biofuels

The increasing emphasis on renewable energy sources is driving the demand for biofuels, which are derived from fatty acids. As countries strive to reduce their carbon footprints, the use of fatty acids in biofuel production is becoming more prevalent. The market for biofuels is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. This trend is likely to bolster The Global fatty acid Industry, as manufacturers pivot towards producing fatty acids that meet the specifications for biofuel applications. Furthermore, government incentives and policies promoting biofuel usage are expected to further enhance market growth, creating a robust environment for fatty acid producers.

Expanding Food Industry Applications

The food industry continues to be a major consumer of fatty acids, particularly in the production of emulsifiers, stabilizers, and flavoring agents. As the global population grows, the demand for processed and convenience foods is also on the rise. This trend is likely to drive The Global Fatty Acid Industry, as manufacturers seek to enhance the quality and shelf life of food products. In 2023, the food sector accounted for approximately 40% of the total fatty acid consumption, indicating a substantial market share. Additionally, the increasing consumer preference for natural and organic food products is pushing manufacturers to explore fatty acids derived from sustainable sources, further propelling market dynamics.

Growth in Personal Care and Cosmetics

The personal care and cosmetics sector is witnessing a surge in the use of fatty acids, which are valued for their moisturizing and emulsifying properties. As consumers become more conscious of the ingredients in their personal care products, there is a growing preference for formulations that include natural fatty acids. This shift is likely to influence The Global Fatty Acid Industry positively, as brands reformulate products to meet consumer demands. The personal care market is projected to reach USD 500 billion by 2025, with fatty acids playing a crucial role in product development. This growth presents opportunities for fatty acid suppliers to cater to the evolving needs of the cosmetics industry.

Innovations in Industrial Applications

Innovations in industrial applications of fatty acids are emerging as a key driver for market growth. Fatty acids are increasingly utilized in the production of lubricants, surfactants, and detergents, which are essential in various manufacturing processes. The industrial sector's demand for high-performance materials is likely to enhance The Global Fatty Acid Industry, as manufacturers seek to develop more efficient and sustainable products. The global market for industrial lubricants is expected to grow at a CAGR of around 4% through 2025, indicating a robust demand for fatty acids in this segment. This trend suggests that fatty acid producers may need to invest in research and development to innovate and meet the specific requirements of industrial applications.

Regulatory Support for Sustainable Practices

Regulatory frameworks promoting sustainable practices are increasingly influencing the fatty acid market. Governments worldwide are implementing policies that encourage the use of renewable resources and environmentally friendly production methods. This regulatory support is likely to benefit The Global Fatty Acid Industry, as it aligns with the growing consumer demand for sustainable products. For instance, regulations aimed at reducing plastic waste are driving the development of biodegradable fatty acid-based alternatives. As a result, manufacturers are expected to adapt their production processes to comply with these regulations, potentially leading to increased investment in sustainable fatty acid production technologies. This shift may create new market opportunities and enhance the competitive landscape.