Government Initiatives and Policies

Government initiatives aimed at promoting clean energy and sustainable technologies are pivotal for the Global Fast Charge Lithium Ion Battery Market Industry. Various countries are implementing policies that encourage the development and adoption of fast-charging battery technologies. These initiatives often include funding for research, tax incentives for manufacturers, and regulations that promote the use of electric vehicles. Such supportive measures are likely to create a conducive environment for market growth, as stakeholders align their strategies with governmental objectives. The anticipated market value of 75 USD Billion by 2035 underscores the potential impact of these initiatives.

Rising Demand for Electric Vehicles

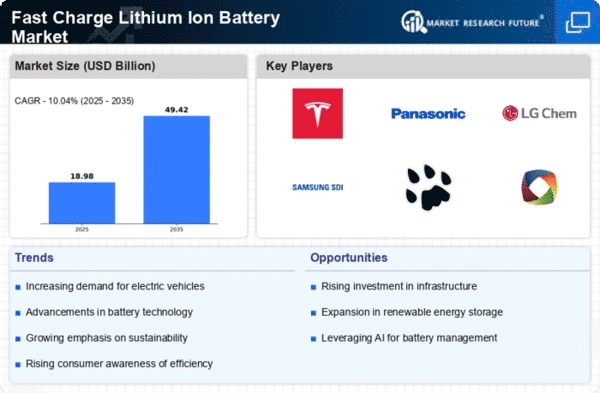

The increasing adoption of electric vehicles (EVs) is a primary driver for the Global Fast Charge Lithium Ion Battery Market Industry. As governments worldwide implement stricter emissions regulations and provide incentives for EV purchases, the demand for fast-charging batteries is expected to surge. In 2024, the market is projected to reach 25 USD Billion, reflecting the growing consumer preference for EVs that require efficient charging solutions. This trend is likely to continue, with the market anticipated to expand significantly as more manufacturers invest in fast-charging technologies to meet consumer expectations.

Growing Renewable Energy Integration

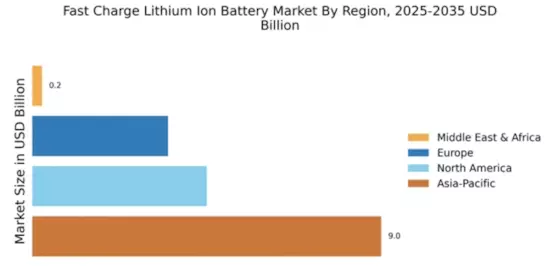

The integration of renewable energy sources into the grid is driving the Global Fast Charge Lithium Ion Battery Market Industry. As solar and wind energy become more prevalent, the need for efficient energy storage solutions is paramount. Fast charge lithium-ion batteries play a crucial role in storing excess energy generated during peak production times, enabling a more stable energy supply. This trend is expected to bolster market growth, as energy storage systems become increasingly essential for balancing supply and demand. The market's expansion is anticipated to align with the broader shift towards sustainable energy practices.

Consumer Electronics Market Expansion

The rapid growth of the consumer electronics sector is significantly influencing the Global Fast Charge Lithium Ion Battery Market Industry. With the proliferation of smartphones, tablets, and wearable devices, the demand for batteries that support quick charging capabilities is on the rise. Manufacturers are increasingly prioritizing fast-charging technology to enhance user experience and meet consumer expectations. This trend is expected to contribute to the market's growth, as the consumer electronics industry continues to expand. The synergy between fast charge batteries and consumer electronics is likely to create new opportunities for innovation and market penetration.

Technological Advancements in Battery Chemistry

Innovations in battery chemistry are propelling the Global Fast Charge Lithium Ion Battery Market Industry forward. Research and development efforts are focusing on enhancing energy density, reducing charging times, and improving overall battery lifespan. For instance, advancements in solid-state batteries and lithium-silicon anodes may lead to faster charging capabilities and increased safety. These technological breakthroughs not only enhance performance but also attract investments, contributing to the market's growth. As a result, the industry is likely to witness a compound annual growth rate (CAGR) of 10.5% from 2025 to 2035, indicating a robust future.