Access to Capital

Access to capital remains a critical factor influencing the Farm Equipment Rental Market. Many farmers face challenges in securing financing for purchasing expensive machinery. Renting equipment offers a viable alternative, allowing farmers to utilize high-quality machinery without the upfront costs associated with ownership. This trend is particularly pronounced among small to medium-sized farms, which often operate on tighter budgets. Data indicates that approximately 40% of farmers prefer renting over buying due to financial constraints. As such, the Farm Equipment Rental Market is likely to thrive as it provides accessible solutions for farmers seeking to enhance their operational capabilities.

Rising Labor Costs

The Farm Equipment Rental Market is experiencing a notable increase in labor costs, which is compelling farmers to seek cost-effective alternatives. As wages rise, particularly in agricultural sectors, the financial burden on farmers intensifies. This situation encourages the adoption of rental services, as they provide access to high-quality machinery without the long-term commitment of ownership. In fact, data indicates that rental services can reduce operational costs by up to 30%, making them an attractive option for many. Consequently, the Farm Equipment Rental Market is likely to see sustained growth as farmers prioritize efficiency and cost management.

Environmental Regulations

Increasing environmental regulations are shaping the Farm Equipment Rental Market. As governments implement stricter guidelines to promote sustainable farming practices, farmers are compelled to adopt eco-friendly equipment. Rental services provide an efficient means to access such machinery without the need for significant capital investment. The trend towards sustainability is likely to drive the demand for rental services, as farmers seek to comply with regulations while minimizing their environmental footprint. This shift may result in a 15% growth in the Farm Equipment Rental Market as more farmers opt for sustainable solutions.

Technological Advancements

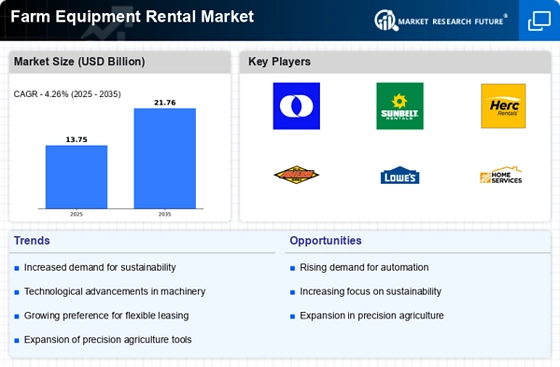

Technological innovations are significantly influencing the Farm Equipment Rental Market. The introduction of precision agriculture tools and smart machinery enhances productivity and efficiency. Farmers are increasingly inclined to rent advanced equipment that incorporates the latest technologies, such as GPS and automated systems, which can optimize crop yields. Reports suggest that the adoption of such technologies can lead to a 20% increase in productivity. As a result, the Farm Equipment Rental Market is poised for expansion, driven by the demand for cutting-edge solutions that improve operational effectiveness.

Seasonal Demand Fluctuations

The Farm Equipment Rental Market is characterized by seasonal demand fluctuations, which create opportunities for rental services. During peak planting and harvesting seasons, farmers often require additional machinery to meet increased workload. Renting equipment allows them to scale operations without the financial strain of purchasing new machinery. Data shows that rental services can see demand spikes of up to 50% during these critical periods. This dynamic nature of agricultural operations positions the Farm Equipment Rental Market favorably, as it caters to the varying needs of farmers throughout the year.