Technological Innovations

Technological innovations play a crucial role in shaping the Explosion Protection Equipment Market. The advent of advanced materials and smart technologies has led to the development of more effective and efficient explosion protection solutions. For instance, the integration of IoT and AI in explosion protection equipment allows for real-time monitoring and predictive maintenance, enhancing safety measures. The market for smart explosion protection systems is anticipated to grow significantly, with estimates suggesting a compound annual growth rate of 7% over the next five years. This growth is driven by the need for enhanced safety and operational efficiency in industries such as manufacturing and energy. As companies increasingly adopt these technologies, the demand for innovative explosion protection equipment is likely to rise, further propelling the market forward.

Growth in Emerging Markets

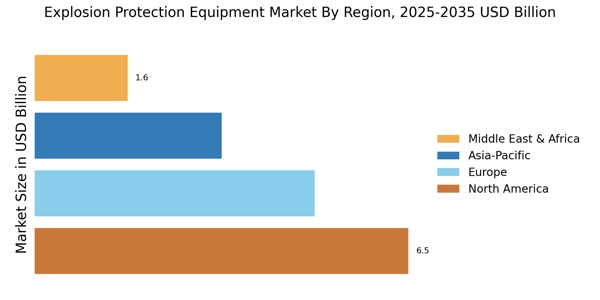

The growth in emerging markets is emerging as a vital driver for the Explosion Protection Equipment Market. As economies in regions such as Asia-Pacific and Latin America continue to develop, industrial activities are on the rise, leading to an increased need for explosion protection solutions. The expansion of sectors such as construction, manufacturing, and energy in these regions is likely to create substantial demand for explosion protection equipment. Market analysis suggests that the Asia-Pacific region alone could account for over 30% of The Explosion Protection Equipment Market by 2030. This growth is attributed to the rapid industrialization and urbanization occurring in these markets, which necessitates the implementation of safety measures to protect workers and assets. Consequently, manufacturers are focusing on these emerging markets to capitalize on the growing demand for explosion protection solutions.

Increasing Industrialization

The ongoing trend of industrialization across various sectors appears to be a primary driver for the Explosion Protection Equipment Market. As industries expand, the risk of explosive atmospheres increases, necessitating the implementation of robust explosion protection measures. According to recent data, the manufacturing sector alone is projected to grow at a rate of 4.5% annually, which could lead to heightened demand for explosion protection solutions. This growth is particularly evident in sectors such as chemicals, oil and gas, and pharmaceuticals, where the presence of flammable materials is prevalent. Consequently, companies are investing in advanced explosion protection equipment to mitigate risks and ensure compliance with safety regulations. This trend indicates a sustained demand for innovative solutions within the Explosion Protection Equipment Market.

Stringent Regulatory Frameworks

The presence of stringent regulatory frameworks is a significant driver for the Explosion Protection Equipment Market. Governments and regulatory bodies worldwide have established comprehensive safety standards to mitigate the risks associated with explosive environments. Compliance with these regulations is mandatory for industries such as oil and gas, chemicals, and mining, which are prone to explosive hazards. The implementation of regulations such as ATEX and IECEx has led to increased investments in explosion protection equipment, as companies strive to meet safety requirements. Recent data indicates that the market for explosion protection equipment is expected to grow at a CAGR of 5.2% over the next five years, largely due to the enforcement of these regulations. This trend highlights the critical role of regulatory compliance in driving the demand for explosion protection solutions.

Rising Awareness of Workplace Safety

There is a growing awareness regarding workplace safety, which significantly influences the Explosion Protection Equipment Market. Organizations are increasingly prioritizing employee safety and health, leading to the adoption of stringent safety protocols. This heightened focus on safety is reflected in the increasing investments in explosion protection equipment, as companies seek to prevent accidents and protect their workforce. Data suggests that The Explosion Protection Equipment Market is expected to reach USD 60 billion by 2026, indicating a substantial opportunity for explosion protection equipment manufacturers. Furthermore, the implementation of safety training programs and awareness campaigns has contributed to a cultural shift towards prioritizing safety, thereby driving the demand for explosion protection solutions. This trend underscores the importance of safety in the operational strategies of various industries.