Excavators Market Summary

As per Market Research Future analysis, the Excavators Market Size was estimated at 74.5 USD Billion in 2024. The Excavators industry is projected to grow from 78.6 USD Billion in 2025 to 134.3 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 5.50% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Excavators Market is poised for robust growth driven by technological advancements and urbanization.

- Technological advancements are reshaping the excavators market, enhancing efficiency and performance.

- Sustainability initiatives are increasingly influencing equipment design and operational practices across the industry.

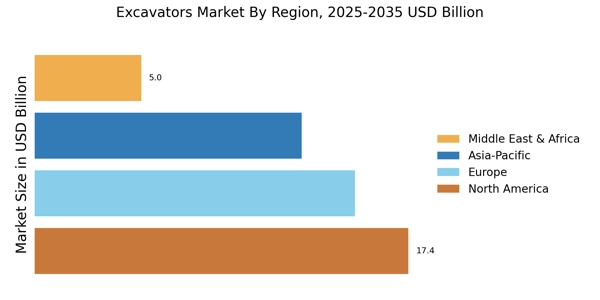

- North America remains the largest market, while the Asia-Pacific region is recognized as the fastest-growing area for excavators.

- The rising demand for construction equipment and government initiatives are key drivers propelling market expansion.

Market Size & Forecast

| 2024 Market Size | 74.5 (USD Billion) |

| 2035 Market Size | 134.3 (USD Billion) |

| CAGR (2025 - 2035) | 5.50% |

Major Players

Caterpillar Inc., Komatsu Ltd., Hitachi Construction Machinery, Volvo Construction Equipment, Deere & Company (John Deere), SANY Group, Doosan Infracore, JCB, Kobelco Construction Machinery, and XCMG Group.