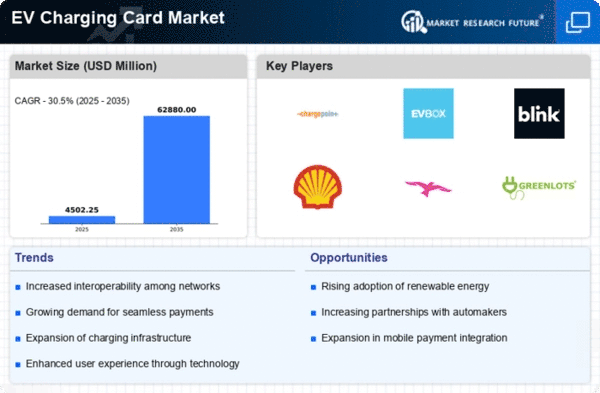

Market Growth Projections

The Global EV Charging Card Market Industry is poised for remarkable growth, with projections indicating a substantial increase in market value. The market is expected to reach 3.5 USD Billion in 2024 and is forecasted to expand to 15.2 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 14.28% from 2025 to 2035. Such projections highlight the increasing importance of EV charging cards as essential tools for facilitating electric vehicle usage. The anticipated growth reflects broader trends in the automotive industry, where electric vehicles are becoming increasingly mainstream, thereby necessitating robust charging solutions.

Consumer Awareness and Education

Consumer awareness and education regarding electric vehicles and charging solutions are essential for the growth of the Global EV Charging Card Market Industry. As consumers become more informed about the benefits of electric vehicles, including lower operating costs and environmental advantages, their willingness to adopt this technology increases. Educational campaigns by governments and organizations aim to demystify electric vehicle ownership and charging processes. This heightened awareness is likely to drive demand for EV charging cards, as consumers seek reliable and efficient payment methods for charging their vehicles. The ongoing efforts to educate the public could significantly influence market dynamics in the coming years.

Rising Electric Vehicle Adoption

The Global EV Charging Card Market Industry is experiencing substantial growth due to the increasing adoption of electric vehicles worldwide. As governments implement stricter emissions regulations and provide incentives for EV purchases, consumer interest in electric vehicles is surging. In 2024, the market is projected to reach 3.5 USD Billion, reflecting a significant shift in consumer preferences towards sustainable transportation. This trend is expected to continue, with the market potentially expanding to 15.2 USD Billion by 2035. The growing number of electric vehicles on the road necessitates a corresponding increase in charging infrastructure, thereby driving demand for EV charging cards.

Expansion of Charging Infrastructure

The expansion of charging infrastructure is a pivotal driver for the Global EV Charging Card Market Industry. As more charging stations are installed in urban and rural areas, the accessibility of charging facilities increases, thereby encouraging electric vehicle adoption. This infrastructure growth is often supported by public-private partnerships, which facilitate the development of extensive charging networks. The increasing number of charging points is expected to correlate with the rising demand for EV charging cards, as users seek convenient payment solutions. With the market projected to grow to 15.2 USD Billion by 2035, the expansion of charging infrastructure is likely to remain a key focus for stakeholders.

Government Initiatives and Incentives

Government initiatives play a crucial role in shaping the Global EV Charging Card Market Industry. Various countries are implementing policies to promote electric vehicle usage, including tax credits, rebates, and grants for charging infrastructure development. These incentives not only encourage consumers to purchase electric vehicles but also stimulate the growth of charging networks. As a result, the demand for EV charging cards is likely to rise. For instance, in regions where government support is robust, the market is expected to witness a compound annual growth rate of 14.28% from 2025 to 2035, indicating a strong correlation between policy support and market expansion.

Technological Advancements in Charging Solutions

Technological advancements are significantly influencing the Global EV Charging Card Market Industry. Innovations in charging technology, such as faster charging solutions and smart charging systems, enhance user experience and convenience. These advancements not only reduce charging times but also enable better integration with renewable energy sources. As technology continues to evolve, the market for EV charging cards is likely to expand, catering to a more tech-savvy consumer base. The introduction of mobile applications that facilitate charging station location and payment processing further supports this growth, making EV charging more accessible and efficient for users.