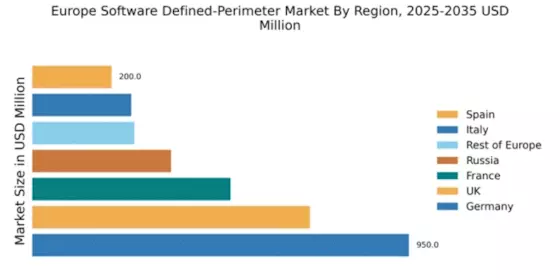

Germany : Strong Demand and Innovation Hub

Germany holds a dominant position in the European software defined-perimeter market, accounting for approximately 30% of the total market share with a value of $950.0 million. Key growth drivers include a robust industrial base, increasing cybersecurity threats, and government initiatives promoting digital transformation. The demand for secure remote access solutions is rising, driven by the shift to hybrid work models and stringent data protection regulations like the GDPR, which encourage businesses to invest in advanced security measures.

UK : Innovation and Investment Surge

The UK software defined-perimeter market is valued at $700.0 million, representing about 23% of the European market. Growth is fueled by increasing cyber threats and a strong push for digital transformation across sectors. The UK government has implemented various initiatives to enhance cybersecurity resilience, including the National Cyber Security Strategy, which promotes investment in innovative security technologies. The demand for secure cloud services is particularly high, reflecting a shift in consumption patterns.

France : Focus on Compliance and Security

France's market for software defined-perimeter solutions is valued at $500.0 million, capturing around 17% of the European market. Growth is driven by stringent compliance requirements, particularly in finance and healthcare sectors, alongside increasing awareness of cybersecurity risks. The French government has launched initiatives to bolster national cybersecurity capabilities, including funding for innovative tech startups. This regulatory environment fosters a strong demand for advanced security solutions.

Russia : Focus on Local Solutions and Security

The Russian market for software defined-perimeter solutions is valued at $350.0 million, accounting for about 12% of the European market. Key growth drivers include rising cyber threats and a push for local data sovereignty. The government has implemented regulations to promote domestic cybersecurity solutions, which has led to increased demand for local providers. The market is characterized by a focus on compliance with national security laws and a growing interest in cloud security solutions.

Italy : Investment in Digital Infrastructure

Italy's software defined-perimeter market is valued at $250.0 million, representing approximately 8% of the European market. Growth is driven by increasing investments in digital infrastructure and a rising awareness of cybersecurity risks among businesses. The Italian government has introduced initiatives to enhance cybersecurity resilience, particularly in critical sectors like finance and healthcare. This regulatory support is fostering demand for advanced security solutions across various industries.

Spain : Focus on Innovation and Compliance

Spain's market for software defined-perimeter solutions is valued at $200.0 million, capturing around 7% of the European market. The growth is driven by increasing cyber threats and a strong emphasis on compliance with EU regulations. The Spanish government has launched initiatives to promote cybersecurity awareness and investment in innovative technologies. This environment is fostering demand for secure access solutions, particularly in sectors like finance and telecommunications.

Rest of Europe : Varied Growth Across Regions

The Rest of Europe market for software defined-perimeter solutions is valued at $257.5 million, accounting for about 9% of the total European market. Growth varies significantly across countries, driven by local regulations and market maturity. Countries like the Netherlands and Sweden are leading in innovation, while others are focusing on compliance and security. The competitive landscape includes both local and international players, with a growing emphasis on tailored solutions for specific industries.