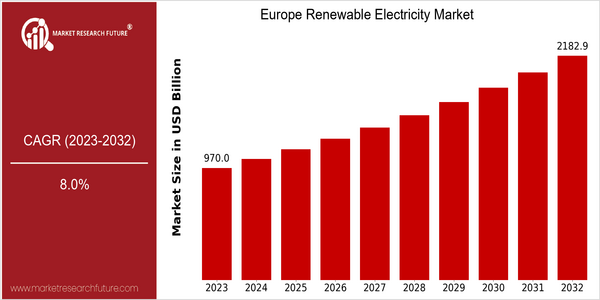

Europe Renewable Electricity Size

Market Size Snapshot

| Year | Value |

|---|---|

| 2023 | USD 970.0 Billion |

| 2032 | USD 2182.9 Billion |

| CAGR (2023-2032) | 8.0 % |

Note – Market size depicts the revenue generated over the financial year

The market for regenerative electricity is valued at $ 97 billion in 2023, and is expected to reach $ 2,182 billion in 2032, registering a CAGR of 8.0% during the forecast period. This significant growth trajectory is due to the increasing emphasis on sustainable energy solutions and the transition away from fossil fuels. As countries try to meet their climate goals and reduce their carbon footprint, the investment in regenerative energy such as solar, wind, and hydropower is increasing, which is driving the market. In addition, technological developments that improve the efficiency and cost-effectiveness of regenerative energy systems also contribute to this market growth. Energy storage systems, smart grids, and the integration of artificial intelligence in energy management systems are important factors that optimize the use of regenerative energy. The market is dominated by large companies such as Siemens-Gamesa, Vestas, and NextEra Energy. These companies have been strengthening their positions through strategic alliances and investments in research and development. The development of new wind- and solar-energy systems is an example of the industry's commitment to innovation and sustainability.

Regional Market Size

Regional Deep Dive

The European Union has a strong commitment to the environment and a strong regulatory framework to reduce carbon emissions. This has led to a high level of investment in renewable energy, especially in wind and solar, driven by the ambitious EU target of being climate-neutral by 2050. A combination of technological progress, increasing public awareness of climate issues and supportive government policy have combined to create a fertile environment for growth and innovation in the renewable electricity market.

Europe

- A large part of this has been a large investment in offshore wind energy by companies like rsted and Siemens.

- Germany’s policy of “energy transition” continues to support the development of renewable energy sources, and the goal of the government is to increase the share of electricity from renewable sources to at least 65 percent by the year 2030. The Federal Government’s energy policy is supported by the efforts of the German Energy Agency (dena) and the German Solar Energy Society (BEE).

Asia Pacific

- China remains the world's largest producer of solar panels and has implemented policies to support the growth of renewable energy, including the 14th Five-Year Plan, which emphasizes the importance of clean energy development.

- India's ambitious target of achieving 450 GW of renewable energy capacity by 2030 is supported by government initiatives like the Solar Park Scheme, which has attracted significant foreign investment from companies such as Adani Green Energy.

Latin America

- Brazil is leading the way in renewable energy in Latin America, with hydropower accounting for over 60% of its electricity generation, while also investing in wind and solar energy projects to diversify its energy portfolio.

- Chile has become a hotspot for solar energy, with the Atacama Desert providing ideal conditions for solar farms, and the government has set a target to generate 70% of its electricity from renewable sources by 2050.

North America

- In the United States, the growth of solar power is accelerated by the tax benefits of the federal government and by the quotas of the states.

- Canada's commitment to phasing out coal-fired power plants by 2030 has led to increased investments in hydroelectric and wind energy projects, with companies like Brookfield Renewable Partners leading the charge.

Middle East And Africa

- The UAE's Mohammed bin Rashid Al Maktoum Solar Park is set to become one of the largest solar parks in the world, with a planned capacity of 5,000 MW, showcasing the region's commitment to diversifying its energy sources.

- South Africa's Renewable Energy Independent Power Producer Procurement Programme (REIPPPP) has successfully attracted investments in wind and solar projects, contributing to the country's goal of increasing renewable energy's share in the energy mix.

Did You Know?

“As of 2021, Europe accounted for nearly 40% of the world's offshore wind capacity, with the UK and Germany being the leading countries in this sector.” — Global Wind Energy Council (GWEC)

Segmental Market Size

The Europe Renewable Energy Market is characterized by rapid growth, which is mainly due to increasing demand for sustainable energy solutions from consumers and strict regulations aimed at reducing carbon emissions. In addition, the Green Deal of the European Union, which imposes a large reduction in greenhouse gas emissions, also contributes to the development of the market. These factors are promoting the investment in wind, solar and hydropower. The market is currently at the stage of large-scale implementation. Germany and Denmark lead in wind energy, while Spain is leading in the field of solar energy. The most important projects are the Hornsea One offshore wind farm in the United Kingdom and the Andasol solar power plant in Spain. The main application of renewable electricity is in residential, commercial and industrial buildings, and utilities are increasingly integrating renewables into their energy mix. The trend towards energy independence and the development of energy storage systems, such as lithium-ion batteries, will further boost the market.

Future Outlook

The Europe Renewable Energy Market is set for significant growth from 2023 to 2032. The market is expected to grow from € 970 billion to € 2,182 billion, at a robust CAGR of 8%. This growth is mainly driven by the stringent EU climate policies and the ambitious EU renewable energy goals. By 2032, it is estimated that the share of renewable energy in the total electricity generation in Europe will increase to over 60% from about 40% in 2023. This will represent a major shift in the energy production patterns in the region. The technological advancements, especially in the solar and wind energy sectors, will play a major role in this shift. In addition, the new developments in energy storage and smart grid technology will enhance the reliability and efficiency of the renewable energy systems, thereby enabling their integration with the existing grid. The favourable government policies, such as subsidies and incentives for the deployment of green energy projects, and the increasing investment in the green technology will further drive the market. As the public demand for sustainable energy solutions increases, the market is likely to see the emergence of decentralised energy systems. These systems will enable local communities and businesses to generate and manage their own renewable energy, thereby transforming the energy landscape in Europe.

Leave a Comment