Europe Pv Inverter Size

Market Size Snapshot

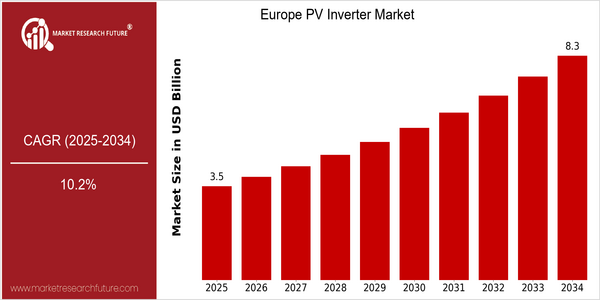

| Year | Value |

|---|---|

| 2025 | USD 3.47 Billion |

| 2034 | USD 8.33 Billion |

| CAGR (2025-2034) | 10.2 % |

Note – Market size depicts the revenue generated over the financial year

The European PV inverter market is expected to reach a size of $3.47 billion by 2025, at a CAGR of 10.2% during the forecast period. This upward trend is attributed to the growing adoption of solar energy solutions in the region, which is a result of favorable government policies, technological advancements, and the rising focus on sustainable energy resources to combat climate change. Also driving the market growth are the declining prices of photovoltaic systems, the increasing demand for energy independence, the increasing availability of smart inverter solutions, and the increasing demand for energy storage solutions. The key players in the market, such as SMA Solar Technology AG, Fronius International GmbH, and ABB Ltd., are focusing on strategic initiatives, such as collaborations and investments in R&D, to enhance their product offerings and expand their market presence. These efforts are expected to propel the market growth and innovation in the photovoltaic inverter market.

Regional Market Size

Regional Deep Dive

Among the repercussions of this escalation in the European market for photovoltaic inverters is the emergence of a new market for concentrating solar inverters. In view of the ambitious goal of achieving zero emissions by 2050 set by the European Union, the market is witnessing a substantial investment in solar energy. In this context, the photovoltaic inverter market is growing, both in the residential and commercial sectors and in the utility-scale sector. Furthermore, technological advances in the efficiency of inverters and their integration into smart grids are improving the performance and reliability of the systems.

Europe

- The European Commission's Green Deal aims to increase the share of renewable energy, leading to a rise in solar installations and consequently, a higher demand for advanced PV inverters.

- Countries like Germany and Spain are leading the way in adopting smart inverter technologies, which facilitate better grid management and integration of renewable energy sources.

Asia Pacific

- China remains the largest market for PV inverters, with significant investments in solar manufacturing and technology, supported by government policies promoting renewable energy.

- The rise of decentralized energy systems in countries like India is driving demand for microinverters and string inverters, which are essential for residential solar installations.

Latin America

- Brazil is emerging as a key player in the PV inverter market, driven by favorable government policies and a growing interest in solar energy among consumers and businesses.

- Innovative financing models, such as power purchase agreements (PPAs), are facilitating the adoption of solar energy solutions, including advanced inverter technologies.

North America

- The U.S. has seen a surge in the deployment of solar energy systems, with the Biden administration's commitment to clean energy and the extension of the Investment Tax Credit (ITC) significantly boosting the PV inverter market.

- Innovations in energy storage solutions, such as Tesla's Powerwall, are driving the demand for hybrid inverters that can manage both solar energy generation and battery storage.

Middle East And Africa

- The UAE's ambitious solar projects, such as the Mohammed bin Rashid Al Maktoum Solar Park, are setting benchmarks for PV inverter technology and deployment in the region.

- Regulatory frameworks in countries like South Africa are evolving to support renewable energy, leading to increased investments in solar infrastructure and inverter technology.

Did You Know?

“In 2022, Europe accounted for over 40% of the global solar PV installations, significantly boosting the demand for PV inverters in the region.” — International Energy Agency (IEA)

Segmental Market Size

The Europe PV inverter market is currently experiencing a steady growth, driven by the growing share of renewable energy and the transition to a sustainable energy system. The most important driving forces are the increasingly stringent regulations aimed at reducing carbon dioxide emissions and the growing preference for energy independence through the use of solar power. Moreover, technological advances, such as the development of smart inverters, which are more efficient and better suited for grid integration, are driving market interest. In Europe, the market is currently in a phase of scale implementation, with Germany, Spain and Italy leading the way in the adoption of PV inverters. SMA Solar Technology and Fronius are the market leaders in this field, offering a wide range of solutions to meet the needs of the market. The most important application areas are residential and commercial rooftop systems, as well as large-scale photovoltaic power stations. The inverters play an important role in converting the DC power generated from the solar cells into AC. The European Green Deal and the increasing investment in the construction of a renewable energy grid are boosting the growth, while the Internet of Things and artificial intelligence are defining the future of inverter functionality and performance.

Future Outlook

The European photovoltaic inverter market is set to grow at a robust CAGR of 10.2% between 2025 and 2034. The growth of this market is driven by the increasing use of renewable energy sources on the continent, which is driven by the increasingly stringent European Union climate policies and the ambitious goal of carbon neutrality by 2050. The demand for efficient and advanced inverters is expected to increase as countries increase their investments in solar energy and as their penetration increases in both the commercial and residential sectors. By 2034, it is expected that solar energy will account for around one-quarter of the total energy mix in Europe, which will drive the market for inverters. In addition, the integration of smart inverter technology and energy storage solutions will also play an important role in shaping the market. These innovations not only improve the efficiency and reliability of the solar energy system but also support grid stability and energy management. The increasing focus on decentralized energy generation and the growing number of prosumers - consumers who produce and consume energy - will also spur demand for advanced inverters. As the market evolves, stakeholders need to be agile and take advantage of emerging trends, such as the growing importance of the Internet of Things and digitalization in energy management.

Leave a Comment