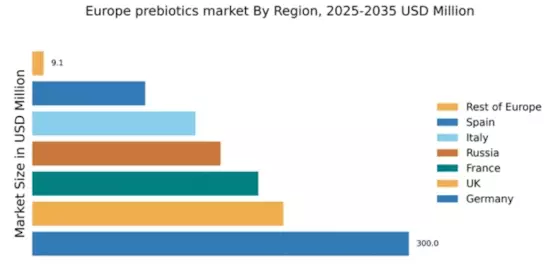

Germany : Strong Demand and Innovation Drive Growth

Germany holds a dominant position in the European prebiotics market, valued at $300.0 million, accounting for approximately 30% of the total market share. Key growth drivers include increasing health awareness, a rising trend towards functional foods, and supportive government initiatives promoting gut health. Regulatory frameworks are favorable, with stringent quality standards ensuring product safety. The country boasts advanced infrastructure and a robust industrial base, facilitating efficient production and distribution of prebiotic products.

UK : Health Consciousness Fuels Market Growth

The UK prebiotics market is valued at $200.0 million, representing about 20% of the European market. The growth is driven by increasing consumer awareness of gut health and the rising popularity of dietary supplements. Regulatory bodies are actively promoting health claims related to prebiotics, enhancing consumer trust. The market is characterized by a shift towards plant-based prebiotics, aligning with the growing vegan trend, and significant investments in research and development.

France : Food and Beverage Sector Dominates

France's prebiotics market is valued at $180.0 million, capturing around 18% of the European market. The growth is propelled by the food and beverage sector, where prebiotics are increasingly incorporated into dairy products and functional foods. Regulatory support for health claims and a focus on natural ingredients are key trends. The French market is also witnessing a rise in demand for organic prebiotics, driven by health-conscious consumers and sustainability initiatives.

Russia : Market Potential in Nutraceuticals

Russia's prebiotics market is valued at $150.0 million, accounting for about 15% of the European market. The growth is fueled by increasing awareness of gut health and a shift towards preventive healthcare. Government initiatives are promoting the development of the nutraceutical sector, which includes prebiotics. The market is characterized by a growing interest in natural and organic products, with urban areas like Moscow and St. Petersburg leading in consumption.

Italy : Prebiotics in Traditional Foods

Italy's prebiotics market is valued at $130.0 million, representing approximately 13% of the European market. The growth is driven by the integration of prebiotics into traditional Italian foods, such as pasta and dairy products. Regulatory frameworks support innovation in food formulations, encouraging manufacturers to explore new applications. The competitive landscape includes local players focusing on high-quality, artisanal products, particularly in regions like Emilia-Romagna and Lombardy.

Spain : Focus on Functional Foods

Spain's prebiotics market is valued at $90.0 million, making up about 9% of the European market. The growth is driven by a rising focus on functional foods and dietary supplements among health-conscious consumers. Regulatory support for health claims related to prebiotics is enhancing market credibility. Key cities like Madrid and Barcelona are witnessing increased demand, with local companies innovating to meet consumer preferences for natural ingredients and transparency in sourcing.

Rest of Europe : Diverse Opportunities Across Regions

The Rest of Europe prebiotics market is valued at $9.08 million, representing a small but growing segment of the overall market. Growth is driven by niche applications in health foods and supplements, with increasing consumer interest in gut health. Regulatory environments vary, but many countries are adopting EU standards, facilitating market entry for new players. Local dynamics are characterized by a mix of established brands and emerging startups focusing on innovative prebiotic solutions.