Rising Prevalence of Diabetes

The increasing prevalence of diabetes across Europe is a primary driver for the Europe Pen Needle Market. As of 2025, approximately 60 million individuals in Europe are estimated to be living with diabetes, leading to a heightened demand for insulin delivery devices. This surge in diabetes cases necessitates the use of pen needles, which are favored for their convenience and ease of use. The Europe Pen Needle Market is likely to experience substantial growth as healthcare providers and patients seek effective solutions for diabetes management. Furthermore, the rising awareness of diabetes care and the importance of regular insulin administration contribute to the market's expansion, indicating a robust future for pen needle products.

Increasing Geriatric Population

The growing geriatric population in Europe is a significant factor driving the Europe Pen Needle Market. By 2025, it is projected that over 20% of the European population will be aged 65 and older, a demographic that often requires chronic disease management, including diabetes care. This age group typically prefers pen needles due to their ease of use and reduced pain perception compared to traditional syringes. Consequently, the demand for pen needles is expected to rise, as healthcare systems adapt to the needs of an aging population. The Europe Pen Needle Market must therefore focus on developing products that cater specifically to the elderly, ensuring accessibility and usability for this growing segment.

Focus on Patient-Centric Healthcare

The shift towards patient-centric healthcare models is reshaping the Europe Pen Needle Market. Healthcare providers are increasingly prioritizing patient preferences and experiences, leading to a demand for more user-friendly and effective pen needle solutions. This trend is reflected in the development of customizable pen needles that cater to individual patient needs, enhancing adherence to treatment regimens. Furthermore, educational initiatives aimed at empowering patients in their diabetes management are gaining momentum. As patients become more engaged in their healthcare decisions, the demand for innovative pen needle products is likely to rise. The Europe Pen Needle Market must adapt to this evolving landscape, ensuring that products align with the principles of patient-centered care.

Technological Innovations in Pen Needles

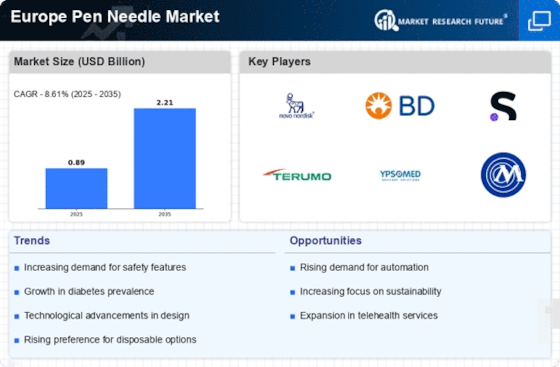

Technological advancements in pen needle design and functionality are significantly influencing the Europe Pen Needle Market. Innovations such as ultra-thin needles, safety features, and improved ergonomics enhance user experience and comfort. The introduction of smart pen needles, which can track dosage and provide feedback, is also gaining traction. These advancements not only improve patient compliance but also reduce the risk of needle-related injuries. As a result, the market is projected to grow, with an estimated compound annual growth rate of 8% over the next five years. The Europe Pen Needle Market is thus positioned to benefit from these technological innovations, catering to the evolving needs of patients and healthcare providers.

Regulatory Support for Diabetes Management

Regulatory frameworks across Europe are increasingly supportive of diabetes management initiatives, which positively impacts the Europe Pen Needle Market. Governments and health organizations are implementing policies that promote the use of advanced diabetes care technologies, including pen needles. This regulatory support is likely to enhance market access for manufacturers and encourage innovation in product development. Additionally, reimbursement policies for diabetes management devices are becoming more favorable, further driving the adoption of pen needles among patients. As a result, the Europe Pen Needle Market is expected to witness growth, as stakeholders align with regulatory guidelines to improve patient outcomes and streamline diabetes care.