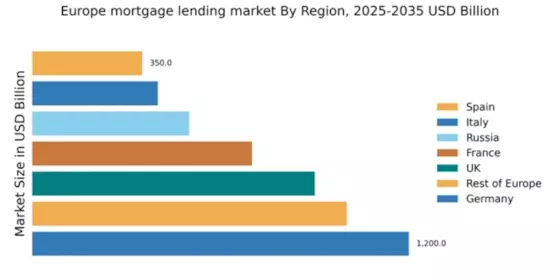

Germany : Strong Growth and Stability in Lending

Germany holds a commanding market share of 30% in the European mortgage lending sector, valued at 1200.0 USD million. Key growth drivers include a robust economy, low unemployment rates, and favorable interest rates. Demand for residential properties continues to rise, supported by government initiatives promoting home ownership. Regulatory policies, such as the Mortgage Credit Directive, ensure consumer protection while fostering a competitive environment. Infrastructure development, particularly in urban areas like Berlin and Munich, further stimulates market growth.

UK : Navigating Challenges with Innovation

The UK mortgage market, valued at €900.0 million, represents 22.5% of the European total. Growth is driven by a recovering economy and increasing demand for housing, particularly in cities like London and Manchester. The government’s Help to Buy scheme has also bolstered home ownership. Regulatory frameworks, including the Financial Conduct Authority's guidelines, ensure responsible lending practices. The market is characterized by a mix of traditional banks and innovative fintech solutions, enhancing competition.

France : Balancing Tradition and Modernity

France's mortgage lending market is valued at €700.0 million, accounting for 17.5% of the European market. Key growth drivers include a stable economy and government incentives for first-time buyers. Demand is particularly strong in urban centers like Paris and Lyon, where property values are rising. Regulatory policies, such as the Loi Pinel, encourage investment in real estate. The competitive landscape features both established banks and emerging online lenders, catering to diverse consumer needs.

Russia : Growth Amid Economic Challenges

Russia's mortgage market, valued at €500.0 million, represents 12.5% of the European total. Growth is driven by increasing consumer confidence and government support for housing initiatives. Demand is particularly strong in major cities like Moscow and St. Petersburg, where urbanization is accelerating. Regulatory policies, including the state program for affordable housing, are pivotal. The competitive landscape includes both local banks and international players, adapting to local market dynamics.

Italy : Revitalization Through Policy Support

Italy's mortgage lending market is valued at €400.0 million, making up 10% of the European market. Key growth drivers include government incentives aimed at stimulating home ownership and a recovering economy. Demand is particularly strong in regions like Lombardy and Lazio, where property markets are rebounding. Regulatory frameworks, such as the First Home Fund, support buyers. The competitive landscape features a mix of traditional banks and new entrants, enhancing consumer choice.

Spain : Post-Crisis Growth and Stability

Spain's mortgage market, valued at €350.0 million, accounts for 8.75% of the European total. Growth is driven by a recovering economy and increasing demand for housing, especially in cities like Madrid and Barcelona. Government initiatives, such as the Plan Estatal de Vivienda, support home buyers. Regulatory policies ensure transparency and consumer protection. The competitive landscape includes both domestic banks and international lenders, fostering a dynamic market environment.

Rest of Europe : Varied Markets with Unique Dynamics

The Rest of Europe mortgage market, valued at €1002.11 million, represents 25% of the total European market. Growth is driven by diverse economic conditions and varying consumer preferences across countries. Key markets include the Netherlands and Belgium, where demand for housing remains strong. Regulatory policies differ significantly, impacting lending practices. The competitive landscape features a mix of local and international players, adapting to regional market dynamics.