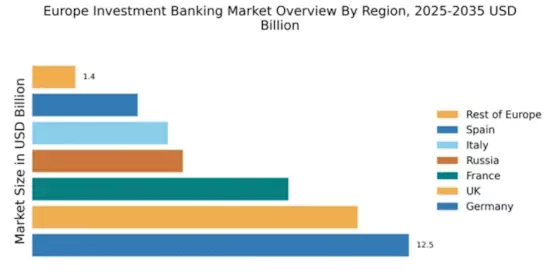

Germany : Strong Market Share and Innovation

Germany holds a commanding 12.5% market share in the European investment banking sector, valued at approximately €30 billion. Key growth drivers include a robust industrial base, increasing M&A activities, and a favorable regulatory environment. The German government has implemented initiatives to enhance financial technology, fostering innovation and attracting foreign investments. Infrastructure development, particularly in major cities like Frankfurt and Berlin, supports the growing demand for investment banking services.

UK : Diverse Services and Global Reach

The UK commands a 10.8% market share in investment banking, valued at around €25 billion. Growth is driven by London’s status as a global financial hub, with increasing demand for advisory services in M&A and capital markets. Regulatory frameworks, such as the Financial Services Act, promote transparency and stability. The competitive landscape features major players like Barclays and JPMorgan Chase, with London being the epicenter of investment banking activities, catering to diverse sectors including technology and healthcare.

France : Growing Market with Regulatory Support

France holds an 8.5% market share in the investment banking sector, valued at approximately €20 billion. Key growth drivers include government initiatives to attract foreign investments and a burgeoning tech startup ecosystem. The French government has introduced policies to streamline regulations, enhancing the business environment. Paris serves as a key market, with major players like BNP Paribas and Société Générale leading the competitive landscape, focusing on sectors such as renewable energy and infrastructure.

Russia : Navigating Challenges and Opportunities

Russia's investment banking market accounts for 5.0% of the European share, valued at around €12 billion. Growth is driven by increasing foreign investments and government initiatives aimed at economic diversification. However, geopolitical tensions and regulatory challenges pose risks. Moscow is the primary market, with significant players like VTB Capital and Sberbank. The competitive landscape is evolving, focusing on sectors such as energy and natural resources, despite a complex business environment.

Italy : Resilience Amid Economic Challenges

Italy captures a 4.5% market share in investment banking, valued at approximately €10 billion. Growth drivers include a recovering economy and increased M&A activities, supported by government reforms aimed at enhancing market efficiency. Regulatory frameworks are evolving to attract investments. Milan is a key market, with major players like UniCredit and Intesa Sanpaolo dominating the landscape. The focus is on sectors such as manufacturing and luxury goods, reflecting Italy's industrial strengths.

Spain : Investment Banking on the Rise

Spain holds a 3.5% market share in the investment banking sector, valued at around €8 billion. Key growth drivers include a recovering economy and increased foreign investments, supported by government initiatives to enhance financial services. Regulatory reforms are aimed at improving market transparency. Madrid and Barcelona are key markets, with major players like Banco Santander and BBVA leading the competitive landscape. The focus is on sectors such as tourism and renewable energy, reflecting Spain's economic strengths.

Rest of Europe : Untapped Potential and Growth Opportunities

The Rest of Europe accounts for a modest 1.43% market share in investment banking, valued at approximately €3 billion. Growth is driven by emerging markets and increasing foreign investments, with various governments implementing policies to attract capital. The competitive landscape is fragmented, with local players dominating. Key markets include cities like Zurich and Vienna, focusing on sectors such as finance and technology, presenting unique opportunities for investment banking services.