Germany : Strong Demand and Innovation Drive Growth

Germany holds a commanding 9.5% market share in the European heat pump sector, valued at approximately €2.5 billion. Key growth drivers include stringent environmental regulations, government incentives for renewable energy, and a growing emphasis on energy efficiency. The demand for heat pumps is rising, particularly in urban areas, as consumers seek sustainable heating solutions. The German government has implemented policies to promote the adoption of heat pumps, including subsidies and tax incentives, which are bolstering market growth. Additionally, advancements in technology and infrastructure development are enhancing the appeal of heat pumps in residential and commercial sectors.

UK : Government Support Fuels Adoption

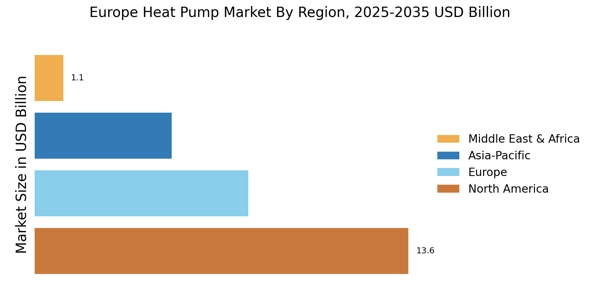

The UK heat pump market accounts for 4.2% of the European share, valued at around €1.1 billion. Growth is driven by government initiatives like the Green Homes Grant, which incentivizes homeowners to install heat pumps. The demand is particularly strong in regions like London and the South East, where energy efficiency is a priority. The UK government is committed to phasing out gas boilers, further boosting heat pump adoption. Infrastructure improvements and rising consumer awareness about sustainability are also contributing to market expansion.

France : Regulatory Framework Supports Growth

France holds a 4.0% market share in the heat pump sector, valued at approximately €1 billion. The market is driven by government policies aimed at reducing carbon emissions and promoting renewable energy sources. The French government offers financial incentives for heat pump installations, which are particularly popular in urban areas like Paris and Lyon. The demand for energy-efficient heating solutions is increasing, supported by rising energy costs and consumer awareness of environmental issues. The competitive landscape features major players like Daikin and Bosch, who are investing in innovative technologies.

Russia : Market Potential Yet to Be Realized

Russia's heat pump market represents 3.0% of the European share, valued at around €750 million. The growth is driven by increasing energy costs and a shift towards energy-efficient solutions. However, the market is still developing, with limited government incentives compared to Western Europe. Key cities like Moscow and St. Petersburg are seeing rising interest in heat pumps, particularly in new residential developments. The competitive landscape includes both local and international players, but market penetration remains low due to economic factors and consumer awareness challenges.

Italy : Incentives Boost Market Adoption

Italy accounts for 2.8% of the European heat pump market, valued at approximately €700 million. The growth is fueled by government incentives such as the Ecobonus program, which encourages energy-efficient renovations. Demand is particularly strong in northern regions like Lombardy and Veneto, where energy efficiency is a priority. The competitive landscape features major players like Mitsubishi Electric and LG Electronics, who are expanding their offerings. The market is characterized by a growing awareness of sustainability and a shift towards renewable energy sources in residential and commercial sectors.

Spain : Renewable Energy Initiatives Drive Growth

Spain's heat pump market holds a 1.8% share of the European market, valued at around €450 million. The growth is driven by government initiatives promoting renewable energy and energy efficiency. Regions like Catalonia and Madrid are key markets, with increasing consumer interest in sustainable heating solutions. The competitive landscape includes both local and international players, with companies like Trane Technologies making significant inroads. The market is evolving, with rising awareness of environmental issues and the benefits of heat pumps in reducing energy costs.

Rest of Europe : Slow Adoption in Smaller Markets

The Rest of Europe accounts for a mere 0.2% of the heat pump market, valued at approximately €50 million. This sub-region includes smaller countries where market penetration is low due to limited awareness and government support. Growth drivers are minimal, with few incentives for heat pump adoption. However, there is potential for growth as energy efficiency becomes a priority across Europe. The competitive landscape is sparse, with only a few local players present. The market dynamics are influenced by economic factors and varying levels of consumer awareness regarding renewable energy solutions.