Regulatory Compliance and Standards

The fuel convenience-store-pos market in Europe is significantly influenced by stringent regulatory compliance and standards. Governments are implementing regulations aimed at ensuring consumer protection, data security, and environmental sustainability. For instance, the General Data Protection Regulation (GDPR) has necessitated that businesses enhance their data handling practices. Compliance with these regulations can be costly, yet it is essential for maintaining consumer trust and avoiding penalties. The market is likely to see an increase in investment towards compliance solutions, which could account for up to 10% of operational budgets. This focus on regulatory adherence not only protects businesses but also enhances their reputation in the eyes of consumers.

Shift Towards Omnichannel Retailing

The fuel convenience-store-pos market in Europe is increasingly shifting towards omnichannel retailing, which integrates various shopping channels to provide a seamless customer experience. This trend is driven by the growing expectation of consumers for flexibility in how they shop and pay. Retailers are adopting POS systems that support both in-store and online transactions, allowing customers to choose their preferred method. Data shows that businesses implementing omnichannel strategies have seen a 20% increase in customer retention rates. As the market evolves, the ability to offer a cohesive shopping experience across multiple platforms will likely become a critical factor for success.

Consumer Preferences for Convenience

In the fuel convenience-store-pos market, evolving consumer preferences are driving the demand for convenience and speed. European consumers increasingly favor quick and efficient shopping experiences, which has led to the rise of convenience stores that offer a variety of products alongside fuel services. Data indicates that approximately 60% of consumers prefer shopping at locations that provide a one-stop solution. This trend compels retailers to optimize their POS systems to facilitate faster transactions and improve customer satisfaction. As a result, the fuel convenience-store-pos market is likely to invest in technologies that streamline operations and enhance the overall shopping experience.

Technological Advancements in POS Systems

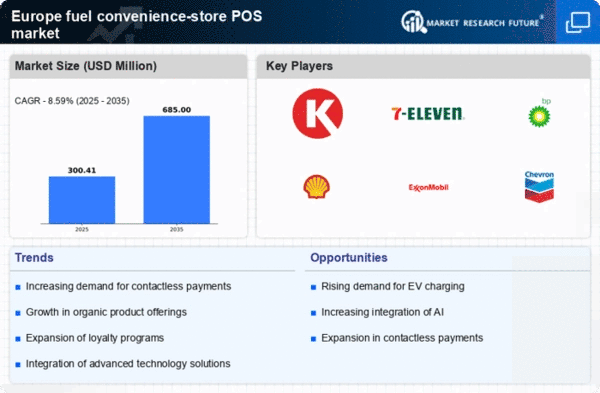

The fuel convenience-store-pos market in Europe is experiencing a notable transformation due to rapid technological advancements. Innovations such as cloud-based POS systems and mobile payment solutions are becoming increasingly prevalent. These technologies enhance transaction speed and accuracy, which is crucial in a competitive environment. According to recent data, the adoption of advanced POS systems has led to a 15% increase in operational efficiency for retailers. Furthermore, the integration of data analytics within these systems allows for better inventory management and customer insights, thereby driving sales. As consumers increasingly demand seamless payment experiences, the fuel convenience-store-pos market must adapt to these technological changes to remain competitive.

Competitive Landscape and Market Consolidation

The fuel convenience-store-pos market in Europe is characterized by a competitive landscape that is witnessing consolidation among key players. Mergers and acquisitions are becoming more common as companies seek to enhance their market share and operational capabilities. This consolidation can lead to improved economies of scale, allowing businesses to reduce costs and offer more competitive pricing. Recent analyses suggest that the top five players in the market control nearly 40% of the total market share. As competition intensifies, companies are likely to invest in innovative POS solutions to differentiate themselves and capture a larger customer base, thereby shaping the future of the market.