Market Share

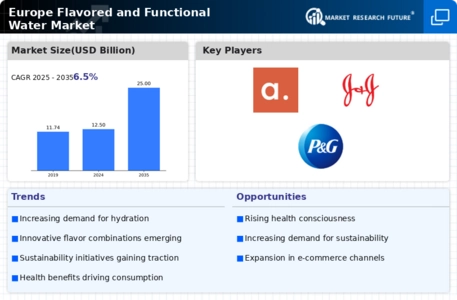

Europe Flavored and Functional Water Market Share Analysis

In the diverse landscape of the European flavored and functional water market, strategic market share positioning is crucial for brands aiming to thrive in this rapidly evolving industry. A prevalent approach involves differentiation through innovative flavors and functional additives. Brands often invest in research and development to create unique and appealing flavor profiles, catering to the preferences of health-conscious consumers who seek refreshing alternatives to sugary beverages. Additionally, the incorporation of functional ingredients such as vitamins, minerals, and antioxidants enhances the nutritional value, setting brands apart in a market where consumers increasingly prioritize beverages that contribute to overall well-being.

Effective branding plays a pivotal role in market share positioning within the flavored and functional water segment. Establishing a strong and memorable brand identity, including eye-catching packaging, logos, and messaging, allows companies to make a lasting impression on consumers. Transparent communication about the sourcing of ingredients, production processes, and any additional health benefits fosters trust with consumers, building brand loyalty and influencing market share.

Innovation in product formulations and packaging is a significant factor in the flavored and functional water market. Brands often explore eco-friendly packaging solutions, such as recyclable materials and minimalist designs, to appeal to environmentally conscious consumers. Additionally, introducing convenient packaging options like on-the-go bottles, multi-serve packs, and eco-refill systems enhances consumer convenience, impacting market share by meeting the diverse and evolving needs of consumers.

Strategic pricing is a key element in market share positioning within the European flavored and functional water industry. Brands must carefully balance affordability with perceived value. Offering value packs, promotional discounts, and strategic pricing for multipacks or subscription services can attract price-sensitive consumers while maintaining profitability and influencing market share in a competitive market.

Distribution channels are integral in determining market share within the flavored and functional water sector. Brands strategically collaborate with supermarkets, convenience stores, gyms, and online retailers to ensure widespread availability. A well-organized distribution network ensures that consumers can easily find and purchase their preferred flavored and functional water brand, contributing to increased market share.

Health and wellness trends have significantly influenced the flavored and functional water market, leading to the development of products targeting specific health concerns. Brands that offer functional waters with immunity-boosting, hydration-enhancing, or relaxation-promoting properties align with consumer demands for beverages that contribute to overall well-being. This strategic move can expand a brand's market share within health-conscious consumer demographics.

Digital marketing and social media engagement are essential tools for connecting with consumers in the flavored and functional water market. Brands utilize online platforms to share engaging content, promote lifestyle associations, and run interactive campaigns. Influencer partnerships, user-generated content, and educational initiatives can enhance brand visibility, influence consumer perceptions, and ultimately impact market share.

Sustainability practices are gaining prominence in the beverage industry, and the flavored and functional water market is no exception. Brands that prioritize environmentally friendly practices, such as sustainable sourcing, responsible packaging, and carbon-neutral initiatives, appeal to environmentally conscious consumers. Sustainability efforts contribute to a positive brand image and may influence market share in a market where ethical and eco-friendly choices are increasingly valued.

Leave a Comment