Rising Demand for Electric Vehicles

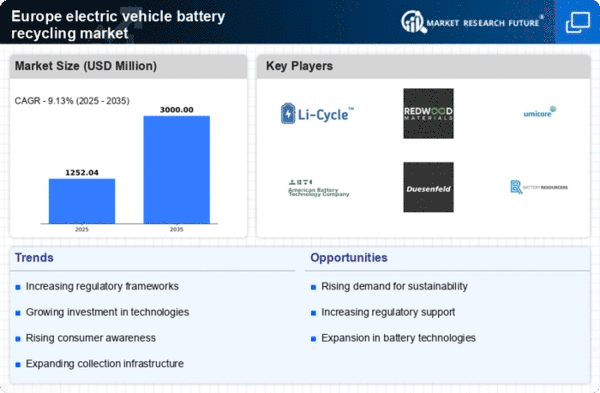

The growing adoption of electric vehicles (EVs) in Europe is a significant driver for the Electric Vehicle Battery Recycling Market. As of 2025, the number of electric vehicles on European roads is projected to exceed 10 million, leading to an increase in battery waste. This surge in EV usage necessitates efficient recycling solutions to manage the end-of-life batteries. The market for battery recycling is expected to grow in tandem with the EV market, as manufacturers and consumers alike recognize the importance of sustainable practices. This trend indicates a robust future for battery recycling initiatives.

Consumer Awareness and Sustainability Trends

Consumer awareness regarding environmental sustainability is influencing the Europe Electric Vehicle Battery Recycling Market. As individuals become more conscious of their ecological footprint, there is a growing demand for sustainable products and practices. This shift in consumer behavior is prompting manufacturers to prioritize recycling and sustainability in their operations. Surveys indicate that a significant percentage of consumers are willing to pay a premium for products that are environmentally friendly. Consequently, this heightened awareness is likely to drive investments in recycling technologies and services, fostering a more sustainable battery lifecycle.

Economic Incentives and Funding Opportunities

Economic incentives and funding opportunities are playing a pivotal role in the growth of the Europe Electric Vehicle Battery Recycling Market. Various governments and organizations are offering grants and subsidies to promote recycling initiatives and technological advancements. For instance, funding programs aimed at enhancing recycling infrastructure are becoming more prevalent, encouraging private sector investment. These financial incentives not only lower the barriers to entry for new recycling businesses but also stimulate innovation in recycling technologies. As a result, the market is expected to expand, driven by both public and private sector collaboration.

Regulatory Support and Compliance Requirements

The regulatory landscape surrounding the Europe Electric Vehicle Battery Recycling Market is becoming increasingly stringent. Governments are implementing policies that mandate recycling and proper disposal of electric vehicle batteries. The European Union's Battery Directive, for example, sets ambitious targets for battery recycling rates, aiming for at least 50% of lithium-ion batteries to be recycled by 2025. This regulatory framework not only encourages manufacturers to adopt sustainable practices but also creates a structured market for recycling services. Compliance with these regulations is essential for manufacturers, thereby driving demand for recycling solutions and services.

Technological Innovations in Battery Recycling

The Europe Electric Vehicle Battery Recycling Market is experiencing a surge in technological innovations that enhance recycling efficiency. Advanced methods such as hydrometallurgical and pyrometallurgical processes are being developed to recover valuable materials like lithium, cobalt, and nickel from used batteries. These innovations not only improve recovery rates but also reduce environmental impact. For instance, recent advancements have reportedly increased lithium recovery rates to over 90%, which is crucial given the projected demand for lithium-ion batteries in electric vehicles. As technology continues to evolve, it is likely that the recycling processes will become more cost-effective, further driving the market's growth.

Leave a Comment