Market Trends

Introduction

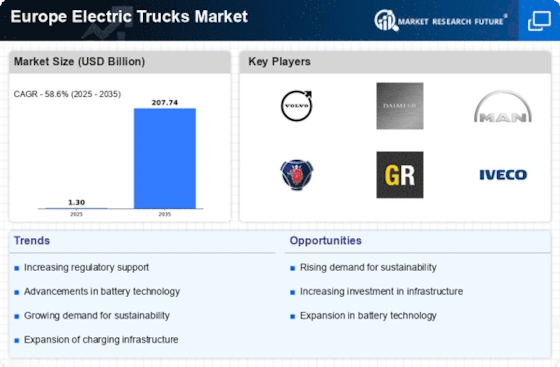

During the years 2021 to 2025, the European Electric Trucks Market is expected to witness a substantial transformation, mainly due to the confluence of macroeconomic factors. The technological advancements in battery and charging technology are enabling electric trucks to reshape the operational capabilities of the vehicles and make them viable for long-haul operations. Meanwhile, the growing regulatory pressures to reduce carbon emissions are compelling fleet operators to adopt sustainable alternatives. The changing consumer preference for greener transportation solutions is also expected to accelerate the shift. These trends are crucial for the industry players, as they will not only influence the investment decisions, but also dictate the strategic positioning in the increasingly eco-conscious market.

Top Trends

-

Government Incentives for Electrification

Moreover, the European governments are increasingly promoting the use of electric trucks with tax breaks and subsidies. For example, the British government has set aside more than 200 million pounds to support the charging stations for electric vehicles. The fleet operators thus have an incentive to move to electric trucks, which helps to increase the penetration of the market. And the operating costs of the companies will be reduced considerably. This is expected to enhance the logistics sustainability. -

Advancements in Battery Technology

The electric truck market is developing because of the progress in battery technology. For example, companies such as Volvo Trucks are investing in solid-state batteries. These batteries promise longer ranges and shorter charging times, thus reducing two of the main barriers to the introduction of electric vehicles. According to some reports, new battery technology can improve the efficiency of electric vehicles by up to 30 percent. This progress will probably lead to a greater acceptance and increased feasibility for electric vehicles in long-distance transport. -

Expansion of Charging Infrastructure

CHARGING STATIONS ACROSS EUROPE ARE CRITICAL TO THE ELECTRIC TRUCKS MARKET. There are many initiatives, such as the European Commission’s Connecting Europe Facility, whose goal is to have thousands of charging stations in place by 2025. This will reduce range anxiety for fleet operators, which will help to speed up the switch to electric trucks. Improved charging facilities will also increase the efficiency of logistics companies and reduce downtime. -

Corporate Sustainability Goals

A large number of companies have set themselves ambitious goals in the field of sustainable development, which in turn have created a demand for electric trucks. DHL, for example, has set itself the goal of achieving zero emissions by 2050, and this has led to the investment in electric trucks. A survey by the consulting firm Bain & Company found that more than 70 per cent of the logistics companies surveyed prioritised sustainable development in their operations. This trend will further increase the uptake of electric trucks and will have a major impact on the supply chain in Europe. -

Regulatory Pressure on Emissions

The re-election of the Socialist government in Poland in the autumn of 1944 was followed by the re-election of the conservative government in 1948. This re-election was followed by the re-election of the government of the National Party in 1950. In the post-war period, the government of the United Kingdom took the lead in the introduction of new legislation on odour emissions from vehicles, and the industry responded by introducing cleaner engines. Nevertheless, as a result of the re-election of the Conservative government in the United Kingdom in the autumn of 1945, the United Kingdom became a pioneer in the introduction of new legislation on odour emissions from vehicles, and as a result of the re-election of the Conservative government in the autumn of 1948, the United Kingdom introduced new legislation on the use of diesel vehicles. -

Increased Collaboration Among Stakeholders

The electric truck is a field where the cooperation between manufacturers, governments and technology companies is very lively. A coalition like the Electric Vehicles Coalition brings together the main players to pool knowledge and resources. This collaboration should accelerate the development of the technology and the charging network, thus increasing the market dynamics and the efficiency of the transport companies. -

Focus on Total Cost of Ownership

Fleet operators are increasingly evaluating the total cost of ownership (TCO) of electric trucks. Studies show that the cost of maintenance for electric trucks is as much as 40 percent lower than for diesel trucks. And this is having an influence on the purchase decision. As the TCO advantages increase in awareness, electric trucks will be more attractive to many industries. -

Integration of Autonomous Technologies

The introduction of the electric truck with an automatic driving system is gaining ground. Companies are working on automatic distribution solutions. Germany is conducting trials with electric trucks in the city. This trend could revolutionize the market, reducing labor costs and increasing productivity. The development could lead to the creation of a fleet of electric vehicles, entirely without drivers, which would radically change the logistics landscape. -

Rise of E-commerce and Last-Mile Delivery

E-commerce has been a driver of the electric vehicle market, especially for last-mile deliveries. In response to customer expectations for greener products, companies like Amazon are investing in electric delivery vans. According to reports, the cost of last-mile deliveries accounts for 53% of the total cost of logistics, and electric vehicles can reduce costs. This is a trend that will probably be reflected in the future of urban logistics and delivery. -

Enhanced Vehicle Connectivity

The Internet of Things and the connected vehicle are transforming the market for electric trucks. The new technology is enabling a real-time, continuous monitoring of the vehicle’s performance and maintenance needs. Companies are using data analysis to optimize routes and reduce energy consumption. This is expected to improve efficiency and reduce costs, making electric trucks more attractive to fleet operators.

Conclusion: Navigating Europe's Electric Truck Landscape

Approaching 2025, the European Electric Trucks Market is characterized by a high degree of competition and fragmentation, with both traditional manufacturers and new entrants fighting for market share. The current regional trends favor the use of electric trucks for commercial and industrial purposes, and the trend towards more sustainable and regulatory-compliant trucks is pushing suppliers to innovate and adjust their strategies accordingly. The market's established suppliers are able to take advantage of their established supply chains and brand names, while new entrants are focusing on cutting-edge technology, such as artificial intelligence and automation, to differentiate themselves. Success will depend on the ability of suppliers to offer flexible solutions that meet diverse customer requirements. The ability to compete in the market will depend on the ability to provide sustainable and efficient solutions that make use of technological developments. It is therefore essential that companies align their strategies with these key market drivers.

Leave a Comment