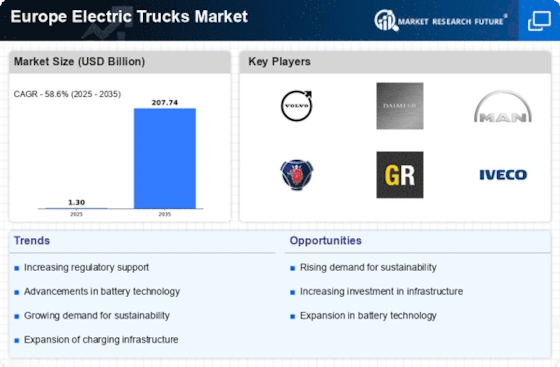

Market Share

Introduction: Navigating the Competitive Landscape of Electric Trucks in Europe

The European electric truck market is experiencing a remarkable increase in competition, driven by the rapid technological developments, the stricter regulations and the rising expectations of consumers in terms of sustainability. Various players such as Original Equipment Manufacturers (OEMs), IT service providers, logistics service providers and innovative artificial intelligence start-ups are striving to take a leading position in this market through differentiated strategies. The truck manufacturers are using data analysis and automation to optimize vehicle performance and increase operational efficiency. The IT companies are concentrating on integrating IoT solutions to optimize fleet management. The network operators are investing in green charging stations to meet the growing demand for electric vehicles. Moreover, with the emergence of new opportunities in urban logistics and last-mile delivery, the strategic trends for 2024 and 2025 are to focus on the integration of biometrics and smart technology in order to meet the growing demand for sustainable transport solutions.

Competitive Positioning

Full-Suite Integrators

These vendors provide comprehensive electric truck solutions, integrating vehicles with advanced technologies and services.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Volvo Trucks | Strong brand reputation and innovation | Electric trucks and related services | Europe |

Emerging Players & Regional Champions

- Volta Trucks (Sweden): The company specializes in electric trucks, especially the Volta Zero, which is designed for urban logistics. In the last mile, the company has already landed contracts with large retailers. The company, which has established itself as a rival to Daimler and Volvo, offers a dedicated electric truck.

- Arrival (UK): specializes in electric vans and buses, with a unique microfactory production system. Recently announced a partnership with a number of logistics companies to provide them with electric vehicles. Against traditional manufacturers such as MAN and Scania, it is positioning itself as a disruptor.

- Sweden: Known for its electric, self-propelled vehicles, like the T-pod. Recent projects with large Swedish companies have been using AI and electric technology to compete with conventional trucking companies.

- A new brand, Tevva, offers a range of electric trucks with hydrogen range extenders for medium-duty use. They have just started working with a logistics company on a fleet trial, and are complementing the range of trucks available from established suppliers with their hybrid solutions.

- Wheelys (Denmark): Focuses on electric delivery trucks for urban environments, emphasizing sustainability and zero emissions. Recently launched a fleet in Copenhagen, challenging traditional delivery services by promoting eco-friendly logistics.

Regional Trends: Europe Electric Trucks Market is witnessing a significant shift towards a more sustainable future, driven by stricter emissions regulations and growing urbanization. The uptake of electric trucks is particularly strong in urban areas, where they are preferred for the final-mile delivery. As for the technological specialization, the trend is towards autonomous driving and hybrid solutions, with the growing emphasis on integrating logistics with the use of renewable energy.

Collaborations & M&A Movements

- Volvo Trucks and Daimler Truck AG entered a joint venture to develop and produce electric powertrains, aiming to enhance their competitive positioning in the growing electric truck segment in Europe.

- Scania and MAN Truck & Bus announced a partnership to share research and development resources for electric truck technologies, which is expected to strengthen their market share against emerging competitors.

- Renault Trucks acquired a minority stake in a battery technology startup to accelerate the development of high-capacity batteries for electric trucks, positioning itself as a leader in sustainable transport solutions.

Competitive Summary Table

| Capability | Leading Players | Remarks |

|---|---|---|

| Sustainability | Volvo Trucks, MAN Truck & Bus | Volvo Trucks has a comprehensive strategy for sustainable development, based on the manufacture of electric trucks and the reduction of CO2 emissions. The electric models, such as the Volvo FL Electric, are intended for city distribution and are examples of the company’s commitment to sustainable transport. The MAN Truck & Bus eTGE and eTruck models are also examples of a company’s commitment to energy efficiency and reduced environmental impact. |

| AI-Powered Ops Mgmt | Scania, Daimler Trucks | Scania has incorporated artificial intelligence into its fleet management system, enabling it to analyse and optimize routes in real time, which increases its efficiency. Daimler Trucks is using artificial intelligence to optimize maintenance and increase the availability of electric trucks. |

| Passenger Experience | Renault Trucks, Iveco | Renault Trucks places the emphasis on the driver’s comfort and convenience in its electric vehicles. Iveco’s electric vehicles are equipped with the most advanced telematics, enabling the driver to access a host of information and to benefit from smart technology. |

| Biometric Self-Boarding | MAN Truck & Bus, Volvo Trucks | MAN Truck & Bus is examining the possibilities of using biometric data to identify the driver to enhance security and facilitate the operation of the vehicle. Similarly, in the area of fleet management, Volvo Trucks is looking at the use of biometric data to improve safety and efficiency. |

| Border Control | Daimler Trucks, Scania | Daimler Trucks is developing solutions that will facilitate the transport of goods across borders and simplify customs procedures. Scania is working on a partnership that will help ensure compliance with international regulations and ensure that its electric trucks meet border control requirements. |

Conclusion: Navigating Europe's Electric Truck Landscape

In Europe the market for electric trucks is characterized by a highly competitive and fragmented market environment. Both established and new manufacturers are competing for market share. The established players use their extensive experience and the existing market structures to carve out their niches, while new entrants focus on innovations and sustainable solutions to carve out their niches. The regional trends are characterized by an increasing focus on compliance with regulations and the development of new capabilities in artificial intelligence, automation and flexibility. These are all areas where the companies with a focus on both efficiency and on sustainability will have a decisive advantage. To ensure long-term success in the electric truck industry, decision-makers must be aware of the prevailing trends and adapt their strategies accordingly.

Leave a Comment