Rising Fuel Prices

The escalating fuel prices across Europe serve as a substantial catalyst for the Europe Electric Bike Market. As consumers face higher costs for gasoline and diesel, many are exploring alternative modes of transportation that offer cost savings. Electric bikes present an economically viable solution, allowing users to bypass fuel expenses altogether. In 2025, it is anticipated that the trend of rising fuel prices will continue, prompting more individuals to invest in electric bikes for their daily commutes. This shift not only enhances the market's appeal but also encourages a broader acceptance of electric mobility solutions. The potential for significant savings on transportation costs is likely to drive increased sales and adoption rates in the electric bike sector.

Government Incentives and Subsidies

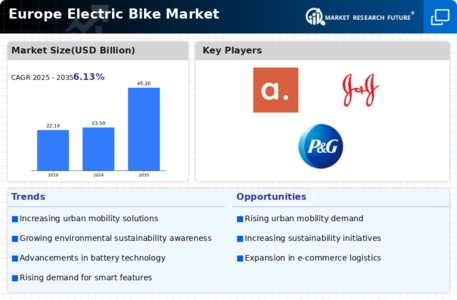

The Europe Electric Bike Market benefits significantly from various government incentives and subsidies aimed at promoting sustainable transportation. Many European countries have implemented financial support mechanisms, such as tax rebates and grants, to encourage consumers to purchase electric bikes. For instance, in 2025, several nations are expected to allocate substantial budgets to support e-bike initiatives, potentially increasing market penetration. This financial backing not only reduces the initial cost for consumers but also enhances the overall attractiveness of electric bikes as a viable alternative to traditional vehicles. As a result, the market is likely to experience accelerated growth, with projections indicating a compound annual growth rate of over 10 percent in the coming years.

Urbanization and Traffic Congestion

The rapid urbanization across Europe is a critical driver for the Europe Electric Bike Market. As cities become increasingly congested, the demand for efficient and eco-friendly transportation solutions rises. Electric bikes offer a practical alternative to cars, allowing commuters to navigate through traffic with ease. In 2025, urban areas are projected to see a significant increase in e-bike usage, as more individuals seek to avoid the frustrations of traditional commuting. This shift not only alleviates traffic congestion but also contributes to reduced carbon emissions, aligning with broader environmental goals. Consequently, the electric bike market is poised for growth, with urban centers likely to become key hubs for e-bike adoption.

Technological Innovations and Features

Technological advancements play a crucial role in shaping the Europe Electric Bike Market. Innovations in battery technology, motor efficiency, and smart features enhance the overall user experience and performance of electric bikes. In 2025, the introduction of more efficient batteries is likely to extend the range of electric bikes, making them more appealing to consumers. Additionally, features such as integrated GPS, smartphone connectivity, and advanced safety systems are becoming increasingly common. These enhancements not only attract tech-savvy consumers but also broaden the market's appeal to a wider audience. As technology continues to evolve, the electric bike market is expected to expand, driven by the demand for high-performance and feature-rich products.

Environmental Awareness and Sustainability

The growing awareness of environmental issues among consumers is a pivotal driver for the Europe Electric Bike Market. As individuals become more conscious of their carbon footprints, there is a marked shift towards sustainable transportation options. Electric bikes, which produce zero emissions during operation, align perfectly with this trend. In 2025, it is expected that the demand for eco-friendly transportation will continue to rise, with electric bikes being viewed as a responsible choice. This heightened environmental consciousness not only influences consumer purchasing decisions but also encourages manufacturers to innovate and improve their offerings. The result is a dynamic market environment where sustainability is at the forefront, driving growth in the electric bike sector.

Leave a Comment