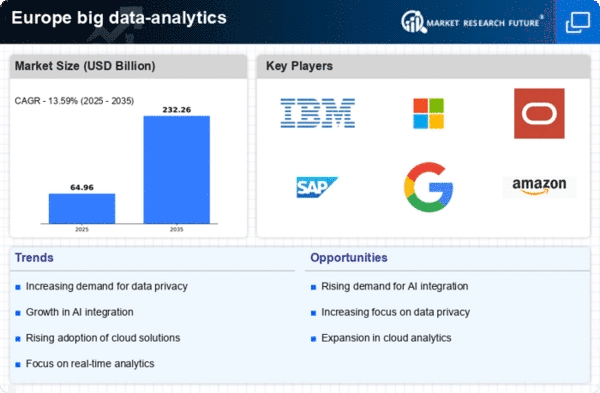

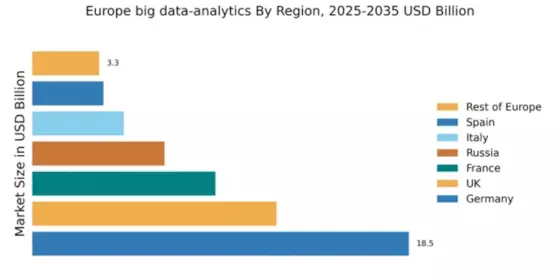

Germany : Strong Growth and Innovation Landscape

Germany holds a commanding 18.5% market share in the big data analytics sector, valued at approximately €5.5 billion. Key growth drivers include a robust industrial base, increasing digital transformation initiatives, and government support for innovation. Demand is rising in sectors like automotive, manufacturing, and finance, driven by the need for data-driven decision-making. Regulatory frameworks, such as the GDPR, ensure data protection while fostering a competitive environment for analytics solutions. Infrastructure investments in broadband and cloud services further enhance market potential.

UK : Innovation and Investment at Forefront

The UK commands a 12.0% market share in the big data analytics market, valued at around €3.6 billion. Growth is fueled by a strong tech ecosystem, with London as a key financial hub driving demand for analytics in finance and retail. The UK government promotes data-driven innovation through initiatives like the Data Strategy, enhancing the business environment. The increasing adoption of AI and machine learning technologies is reshaping consumption patterns, leading to a surge in demand for advanced analytics solutions.

France : Strong Government Support and Demand

France holds a 9.0% market share in the big data analytics market, valued at approximately €2.7 billion. Key growth drivers include government initiatives like the National Strategy for Artificial Intelligence, which promotes data analytics across sectors. Demand is particularly strong in healthcare and retail, where data-driven insights are crucial for operational efficiency. The French market is characterized by a growing number of startups and established players investing in analytics capabilities, supported by a favorable regulatory environment.

Russia : Emerging Opportunities and Challenges

Russia's big data analytics market accounts for 6.5% of the European share, valued at around €1.9 billion. Growth is driven by increasing digitalization across industries, particularly in telecommunications and finance. Government initiatives aimed at enhancing IT infrastructure and data security are pivotal in shaping the market. However, challenges such as regulatory complexities and geopolitical factors may impact foreign investments and market dynamics, necessitating a cautious approach for international players.

Italy : Cultural and Industrial Diversity Drives Growth

Italy represents 4.5% of the big data analytics market in Europe, valued at approximately €1.3 billion. Growth is supported by diverse industries, including fashion, automotive, and tourism, which increasingly rely on data analytics for competitive advantage. Government initiatives promoting digital transformation and innovation are crucial in fostering a conducive environment. The competitive landscape features both local startups and international players, with Milan emerging as a key analytics hub.

Spain : Digital Transformation Fuels Demand

Spain holds a 3.5% market share in the big data analytics sector, valued at around €1.0 billion. The market is driven by the increasing adoption of digital technologies across sectors like retail, finance, and healthcare. Government initiatives aimed at enhancing digital skills and infrastructure are pivotal in supporting market growth. The competitive landscape includes both established firms and emerging startups, with cities like Barcelona and Madrid leading in analytics innovation and application.

Rest of Europe : Varied Growth Across Sub-regions

The Rest of Europe accounts for a 3.29% market share in the big data analytics sector, valued at approximately €950 million. This sub-region encompasses a variety of markets, each with unique growth drivers, including local government initiatives and sector-specific demands. Countries like Belgium and the Netherlands are witnessing increased investments in data analytics, driven by a strong focus on innovation and technology adoption. The competitive landscape is characterized by a mix of local and international players, catering to diverse industry needs.