Rising Demand for Fertilizers

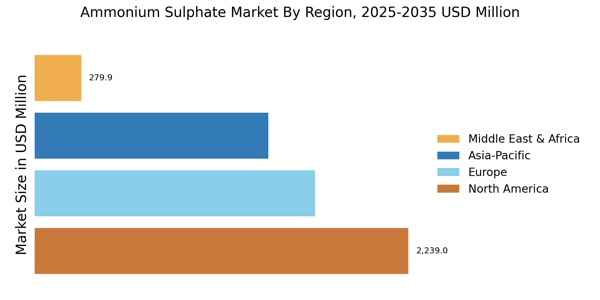

The ammonium sulphate market in Europe is seeing increased demand for fertilizers due to the need for enhanced agricultural productivity. As farmers seek to optimize crop yields, ammonium sulphate, with its dual role as a nitrogen source and soil acidifier, becomes increasingly attractive. Recent data indicates that the fertilizer segment accounts for approximately 60% of the total ammonium sulphate consumption in Europe. This trend is likely to continue as agricultural practices evolve and emphasize nutrient management. Furthermore, the European Union's commitment to sustainable farming practices may further bolster the ammonium sulphate market, as it aligns with the goals of improving soil health and reducing environmental impact.

Shift Towards Organic Farming

The shift towards organic farming in Europe is creating new opportunities for the ammonium sulphate market. Organic farmers often require natural sources of nitrogen, and ammonium sulphate, being a naturally occurring compound, fits well within organic farming guidelines. This trend is reflected in the growing market share of organic fertilizers, which is projected to reach 15% of the total fertilizer market by 2027. As consumer preferences shift towards organic produce, the demand for ammonium sulphate is likely to rise, providing a boost to the market. This transition supports sustainable agriculture and enhances the market's growth potential.

Growing Awareness of Soil Health

There is a burgeoning awareness of soil health among European farmers, which is positively impacting the ammonium sulphate market. As soil degradation becomes a pressing concern, farmers are increasingly recognizing the importance of soil nutrients and their role in crop productivity. Ammonium sulphate, known for its ability to improve soil structure and nutrient availability, is gaining traction as a preferred soil amendment. Recent studies suggest that the application of ammonium sulphate can enhance soil fertility by up to 20%, making it an attractive option for farmers. This heightened focus on soil health is likely to drive demand for ammonium sulphate, further solidifying its position in the agricultural sector.

Environmental Regulations and Compliance

The ammonium sulphate market in Europe is significantly shaped by stringent environmental regulations aimed at reducing nitrogen runoff and promoting sustainable agricultural practices. Regulatory frameworks, such as the EU's Nitrates Directive, impose limits on nitrogen fertilizer usage, thereby influencing the demand for ammonium sulphate. Compliance with these regulations often necessitates the adoption of ammonium sulphate as a preferred nitrogen source due to its lower environmental impact compared to other fertilizers. This regulatory landscape is expected to drive a steady growth in the ammonium sulphate market, as farmers and agricultural businesses seek to align with environmental standards while maintaining productivity.

Technological Advancements in Production

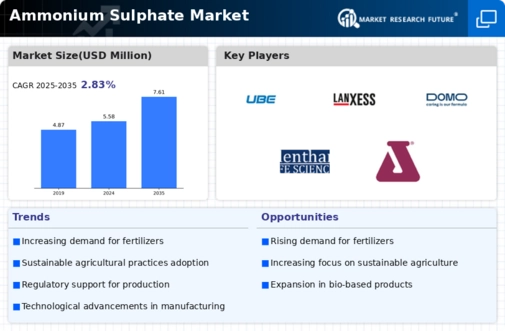

Technological innovations in the production processes of ammonium sulphate are significantly influencing the market dynamics in Europe. Enhanced production techniques, such as the use of more efficient reactors and improved recovery methods, have led to a reduction in production costs. This has made ammonium sulphate more accessible to a broader range of agricultural producers. Moreover, advancements in process optimization are expected to increase the overall output, potentially leading to a market growth rate of around 4% annually. As these technologies continue to evolve, they are likely to enhance the competitiveness of the ammonium sulphate market, allowing it to meet the rising demands of the agricultural sector.