Increasing Incidence of Melanoma

The rising incidence of melanoma across Europe is a pivotal driver for the Europe Melanoma Therapeutics Market. Recent statistics indicate that melanoma cases have surged, with an estimated 200,000 new cases reported annually in Europe. This alarming trend necessitates the development and availability of effective therapeutic options. As awareness of skin cancer increases, more individuals are seeking early diagnosis and treatment, thereby propelling market growth. The heightened focus on melanoma prevention and treatment strategies is likely to stimulate research and development efforts, leading to innovative therapies. Consequently, the growing patient population is expected to drive demand for advanced melanoma therapeutics, thereby shaping the landscape of the Europe Melanoma Therapeutics Market.

Advancements in Targeted Therapies

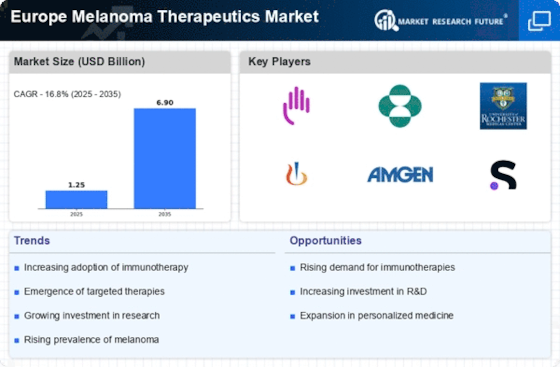

The emergence of targeted therapies represents a transformative shift in the Europe Melanoma Therapeutics Market. These therapies, designed to specifically target cancer cells while sparing healthy tissue, have shown promising results in clinical trials. For instance, BRAF and MEK inhibitors have gained traction, demonstrating improved survival rates among patients with specific genetic mutations. The market for targeted therapies is projected to expand significantly, with estimates suggesting a compound annual growth rate of over 15% in the coming years. This growth is driven by ongoing research and the increasing number of approved targeted agents, which are likely to enhance treatment options for melanoma patients. As a result, the integration of targeted therapies into clinical practice is expected to reshape treatment paradigms within the Europe Melanoma Therapeutics Market.

Growing Investment in Cancer Research

The surge in investment for cancer research is a crucial driver for the Europe Melanoma Therapeutics Market. Governments and private organizations are increasingly allocating funds to support innovative research initiatives aimed at understanding melanoma biology and developing novel therapies. In 2025, it is estimated that research funding for melanoma will exceed 500 million euros across Europe, reflecting a commitment to combating this aggressive form of skin cancer. This influx of capital is likely to facilitate collaborations between academic institutions and pharmaceutical companies, fostering the development of cutting-edge treatments. As a result, the enhanced research landscape is expected to yield breakthroughs in melanoma therapeutics, ultimately benefiting patients and driving market growth.

Rising Awareness and Education Campaigns

The increasing awareness of melanoma and skin cancer prevention is a vital driver for the Europe Melanoma Therapeutics Market. Public health campaigns aimed at educating individuals about the risks associated with UV exposure and the importance of early detection are gaining momentum. These initiatives are likely to lead to higher rates of skin examinations and earlier diagnoses, which can significantly impact treatment outcomes. As awareness grows, more patients are likely to seek therapeutic options, thereby driving market demand. Furthermore, educational programs targeting healthcare professionals are expected to enhance the quality of care provided to melanoma patients. This heightened awareness and education are anticipated to contribute positively to the growth trajectory of the Europe Melanoma Therapeutics Market.

Regulatory Support for Innovative Therapies

Regulatory bodies in Europe are increasingly supportive of innovative therapies, which serves as a significant driver for the Europe Melanoma Therapeutics Market. Initiatives such as the European Medicines Agency's (EMA) accelerated approval pathways are designed to expedite the review process for promising new treatments. This regulatory environment encourages pharmaceutical companies to invest in the development of novel melanoma therapies, as they can bring products to market more swiftly. The potential for faster access to innovative treatments is likely to enhance patient outcomes and satisfaction, thereby increasing the overall demand for melanoma therapeutics. Consequently, the supportive regulatory framework is expected to play a vital role in shaping the future of the Europe Melanoma Therapeutics Market.