Regulatory Compliance

Regulatory compliance is a significant driver in the Ethylene Acrylic Acid (EAA) Copolymers Market. As governments implement stricter regulations regarding material safety and environmental impact, manufacturers are increasingly turning to EAA copolymers. These materials often meet or exceed regulatory standards, making them attractive options for industries such as food packaging and medical applications. The market is expected to grow by approximately 10% as companies prioritize compliance to avoid penalties and enhance consumer trust. This trend not only fosters a safer environment but also encourages the adoption of EAA copolymers across various sectors.

Technological Innovations

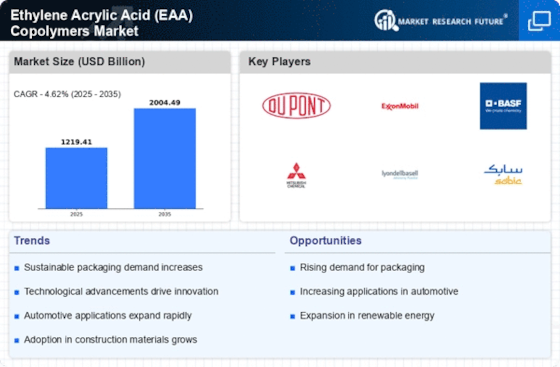

Technological advancements play a pivotal role in shaping the Ethylene Acrylic Acid (EAA) Copolymers Market. Innovations in polymerization techniques and processing methods have led to enhanced properties of EAA copolymers, such as improved adhesion and thermal stability. These advancements enable manufacturers to produce high-performance materials suitable for various applications, including adhesives and coatings. The market is anticipated to witness a growth rate of around 12% annually as companies invest in research and development to leverage these technologies. This focus on innovation not only meets the evolving demands of consumers but also positions EAA copolymers as a preferred choice in competitive markets.

Sustainability Initiatives

The Ethylene Acrylic Acid (EAA) Copolymers Market is increasingly influenced by sustainability initiatives. As environmental concerns rise, manufacturers are compelled to adopt eco-friendly practices. EAA copolymers, known for their recyclability and lower environmental impact, align with these initiatives. The market is projected to grow as industries seek sustainable alternatives to traditional materials. In 2025, the demand for EAA copolymers is expected to increase by approximately 15%, driven by the automotive and packaging sectors prioritizing sustainable materials. This shift not only enhances brand reputation but also meets regulatory requirements, further propelling the market forward.

Expanding Application Scope

The Ethylene Acrylic Acid (EAA) Copolymers Market is characterized by an expanding application scope. EAA copolymers are increasingly utilized in diverse sectors, including automotive, packaging, and construction. Their unique properties, such as excellent adhesion and compatibility with various substrates, make them suitable for a wide range of applications. In 2025, the packaging segment is projected to account for over 30% of the total market share, driven by the demand for high-performance materials that enhance product shelf life. This diversification of applications not only broadens the market base but also stimulates growth as new sectors adopt EAA copolymers for innovative solutions.

Rising Demand in Automotive Sector

The automotive sector is a crucial driver for the Ethylene Acrylic Acid (EAA) Copolymers Market. With the automotive industry increasingly focusing on lightweight materials to improve fuel efficiency, EAA copolymers are gaining traction due to their favorable properties. These materials are utilized in various automotive applications, including fuel tanks and interior components, where durability and performance are paramount. The market is projected to experience a growth rate of around 8%, as manufacturers seek to enhance vehicle performance while adhering to environmental standards. This rising demand not only supports the growth of EAA copolymers but also positions them as essential materials in the evolving automotive landscape.