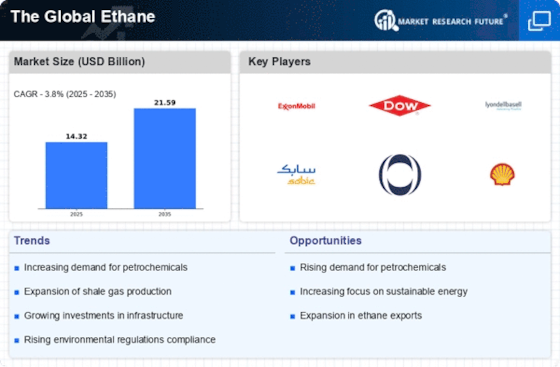

Rising Demand for Petrochemicals

The increasing demand for petrochemicals is a primary driver for The Global Ethane Industry. Ethane Market serves as a crucial feedstock in the production of ethylene, which is a fundamental building block for various plastics and chemicals. As industries expand, particularly in developing regions, the consumption of ethylene is projected to rise significantly. According to recent estimates, the global ethylene production capacity is expected to reach over 200 million metric tons by 2025. This surge in demand for petrochemicals, driven by sectors such as packaging, automotive, and construction, is likely to bolster the ethane market, as manufacturers seek to secure reliable sources of ethane to meet their production needs.

Expansion of Natural Gas Infrastructure

The expansion of natural gas infrastructure plays a pivotal role in shaping The Global Ethane Industry. As countries invest in the development of pipelines and processing facilities, the accessibility of ethane as a byproduct of natural gas extraction increases. This trend is particularly evident in regions with abundant shale gas reserves, where ethane is often separated during processing. The International Energy Agency indicates that natural gas production is set to grow by approximately 25% by 2025, which could lead to a corresponding increase in ethane availability. Enhanced infrastructure not only facilitates the transportation of ethane but also encourages its utilization in various applications, thereby driving market growth.

Growing Focus on Clean Energy Solutions

The growing focus on clean energy solutions is influencing The Global Ethane Industry in various ways. Ethane Market, being a cleaner-burning fossil fuel compared to coal and oil, is increasingly viewed as a transitional energy source. Governments and industries are recognizing the potential of ethane to reduce greenhouse gas emissions while still meeting energy demands. As a result, investments in ethane production and utilization are likely to rise. The U.S. Energy Information Administration projects that ethane production could reach 2.5 million barrels per day by 2025, reflecting a shift towards cleaner energy sources. This trend not only supports environmental goals but also positions ethane as a viable alternative in the energy mix.

Increasing Investment in Ethane-Based Projects

Increasing investment in ethane-based projects is a notable driver for The Global Ethane Industry. As companies recognize the profitability of ethane as a feedstock, there has been a surge in capital allocation towards ethane production facilities and related infrastructure. This trend is particularly pronounced in regions with rich natural gas reserves, where new ethane crackers and processing plants are being established. According to industry reports, investments in ethane-related projects are projected to exceed 50 billion dollars by 2025. Such financial commitments not only enhance production capacity but also stimulate job creation and economic growth in local communities, further solidifying the role of ethane in the global energy landscape.

Technological Innovations in Ethane Extraction

Technological innovations in ethane extraction and processing are significantly impacting The Global Ethane Industry. Advances in extraction techniques, such as enhanced oil recovery and improved separation technologies, are enabling more efficient and cost-effective ethane production. These innovations not only increase the yield of ethane from natural gas but also reduce operational costs for producers. Furthermore, the development of new catalytic processes for converting ethane into valuable chemicals is likely to enhance its market appeal. As companies adopt these technologies, the overall efficiency of ethane production is expected to improve, potentially leading to a more competitive market landscape.