Expansion of 5G Technology

The expansion of 5G technology is poised to significantly impact the Etch Equipment Market. As telecommunications companies roll out 5G networks, the demand for advanced semiconductor devices that support higher data rates and lower latency is increasing. These devices necessitate sophisticated etching processes to achieve the required performance specifications. The 5G infrastructure market is expected to grow substantially, with investments projected to exceed 300 billion dollars by 2025. This growth is likely to drive demand for etch equipment that can produce the intricate features required for next-generation communication devices. Consequently, the Etch Equipment Market may experience a surge in demand as manufacturers seek to enhance their etching capabilities to meet the needs of the evolving telecommunications landscape.

Technological Advancements

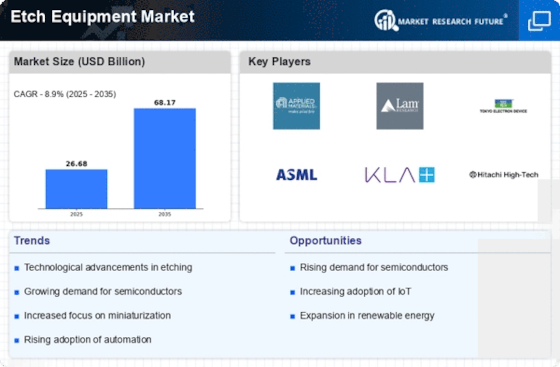

The Etch Equipment Market is experiencing a surge in technological advancements, particularly in the development of more precise and efficient etching techniques. Innovations such as atomic layer etching and advanced plasma etching are enhancing the capabilities of etch equipment, allowing for finer features and improved yield rates. As semiconductor manufacturing processes evolve, the demand for cutting-edge etch equipment is likely to increase. According to recent data, the market for etch equipment is projected to grow at a compound annual growth rate of approximately 6.5% over the next five years, driven by these technological improvements. This trend indicates that manufacturers are investing heavily in R&D to stay competitive, thereby propelling the Etch Equipment Market forward.

Rising Demand for Semiconductors

The Etch Equipment Market is significantly influenced by the rising demand for semiconductors across various sectors, including consumer electronics, automotive, and telecommunications. As industries increasingly rely on advanced electronic components, the need for efficient etching processes becomes paramount. The semiconductor market is expected to reach a valuation of over 600 billion dollars by 2025, which directly correlates with the growth of the etch equipment sector. This burgeoning demand is likely to drive manufacturers to enhance their etching capabilities, thereby fostering innovation within the Etch Equipment Market. Consequently, companies are expected to expand their production capacities to meet the escalating requirements, further solidifying the market's growth trajectory.

Growing Adoption of Electric Vehicles

The growing adoption of electric vehicles (EVs) is emerging as a significant driver for the Etch Equipment Market. As the automotive sector shifts towards electrification, the demand for advanced semiconductor components used in EVs is escalating. These components require precise etching processes to ensure optimal performance and efficiency. The electric vehicle market is projected to witness a compound annual growth rate of over 20% in the coming years, which will likely increase the demand for etch equipment tailored for automotive applications. This trend suggests that manufacturers in the Etch Equipment Market may need to adapt their technologies to cater to the specific requirements of the EV sector, thereby creating new opportunities for growth.

Increased Investment in Research and Development

Investment in research and development is a critical driver for the Etch Equipment Market, as companies strive to innovate and improve their product offerings. With the rapid evolution of technology, manufacturers are allocating substantial resources to develop next-generation etch equipment that meets the stringent requirements of modern semiconductor fabrication. This focus on R&D is not only enhancing the performance of etch equipment but also reducing operational costs for end-users. Recent statistics indicate that R&D spending in the semiconductor equipment sector has increased by approximately 10% annually, reflecting the industry's commitment to advancing etching technologies. Such investments are likely to yield new solutions that address current challenges, thereby propelling the Etch Equipment Market forward.