Growth of Wellness Tourism

The essential oil & aromatherapy Market is significantly influenced by the burgeoning wellness tourism sector. As individuals increasingly prioritize health and well-being, wellness retreats and spas are incorporating aromatherapy into their services. This trend is supported by market data suggesting that wellness tourism is expected to reach a valuation of over 1 trillion dollars in the coming years. Aromatherapy is often featured in spa treatments, yoga sessions, and holistic therapies, enhancing the overall experience for tourists. The integration of essential oils into wellness practices not only promotes relaxation but also aligns with the growing consumer interest in holistic health solutions. Consequently, the Essential Oil & Aromatherapy Market stands to benefit from this intersection of travel and wellness.

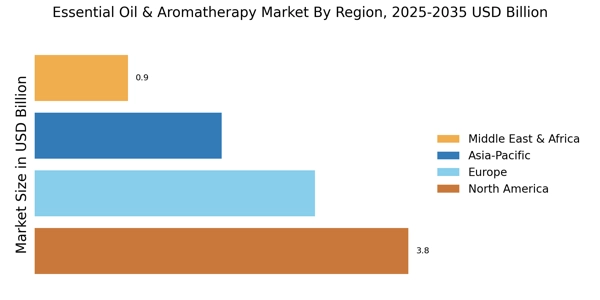

Expansion of E-commerce Platforms

The Essential Oil & Aromatherapy Market is experiencing a transformative shift with the expansion of e-commerce platforms. The convenience of online shopping has made it easier for consumers to access a wide range of essential oils and aromatherapy products. Market data suggests that e-commerce sales in the personal care and wellness sector are projected to grow significantly, driven by the increasing preference for online purchasing. This trend allows consumers to explore various brands, read reviews, and compare products from the comfort of their homes. As a result, the Essential Oil & Aromatherapy Market is likely to see a rise in sales through digital channels, enabling brands to reach a broader audience and enhance customer engagement.

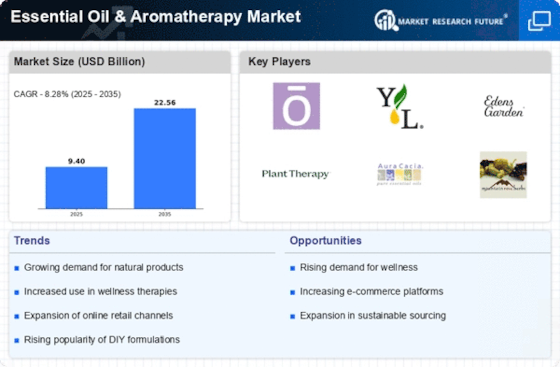

Rising Demand for Natural Products

The Essential Oil & Aromatherapy Market experiences a notable increase in demand for natural and organic products. Consumers are increasingly aware of the potential health risks associated with synthetic chemicals, leading to a shift towards natural alternatives. This trend is reflected in the market data, which indicates that the essential oils segment is projected to grow at a compound annual growth rate of approximately 8% over the next few years. The preference for natural ingredients in personal care, wellness, and household products is driving manufacturers to innovate and expand their offerings in the Essential Oil & Aromatherapy Market. As consumers seek transparency and sustainability, brands that prioritize natural sourcing and ethical practices are likely to gain a competitive edge.

Increased Awareness of Mental Health

The Essential Oil & Aromatherapy Market is witnessing a surge in interest due to the heightened awareness surrounding mental health. As society becomes more attuned to the importance of mental well-being, essential oils are increasingly recognized for their potential therapeutic benefits. Research indicates that certain essential oils, such as lavender and chamomile, may help alleviate stress and anxiety. This growing recognition is reflected in the market, where aromatherapy products are being integrated into mental health practices, including counseling and therapy sessions. The Essential Oil & Aromatherapy Market is thus positioned to capitalize on this trend, as consumers seek natural remedies to support their mental health and emotional balance.

Regulatory Support for Natural Products

The Essential Oil & Aromatherapy Market benefits from increasing regulatory support for natural products. Governments and health organizations are recognizing the importance of promoting natural and organic alternatives in various sectors, including cosmetics and health supplements. This regulatory backing encourages manufacturers to adhere to higher standards of quality and safety, fostering consumer trust. Market data indicates that the demand for certified organic essential oils is on the rise, as consumers seek assurance regarding product integrity. Consequently, the Essential Oil & Aromatherapy Market is likely to thrive as regulations evolve to support the growth of natural products, ultimately benefiting both consumers and manufacturers.