Market Trends

Introduction

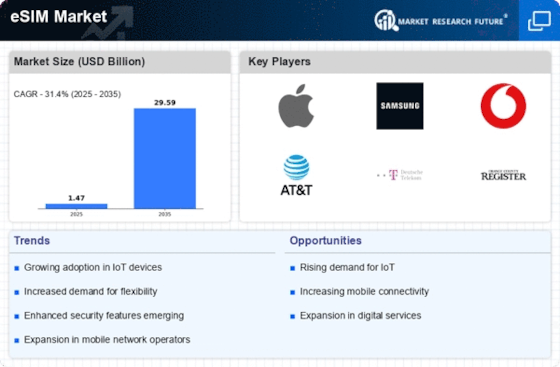

The eSIM market in 2022 is undergoing considerable transformation, driven by technological advancements, regulatory changes and changing customer behaviour. The need for more flexible and efficient access solutions is driving the demand for eSIMs, which offer greater convenience and security. Competition and innovation in the telecommunications sector are also promoting the growth of eSIMs. Moreover, the increasing proliferation of IoT devices and changing consumer preferences for seamless access are reshaping the industry. Industry players need to be ahead of the curve. Strategic insights are needed to seize the opportunities that the evolving eSIM market will offer.

Top Trends

-

Increased Adoption of eSIM in Consumer Electronics

eSIM is becoming the norm in the consumer electronics industry. The major smartphone manufacturers have already incorporated eSIM into their devices. For example, over 50% of new iPhones already support eSIM. This trend will help to enhance convenience for consumers, reduce the need for physical SIM cards, and ultimately lead to the simplification of device design and improved user experience. -

Expansion of IoT Applications

eSIM is becoming an integral part of the Internet of Things (IoT), enabling smart devices to connect seamlessly to the network. eSIM-ready companies such as Deutsche Telekom are already rolling out eSIM solutions for IoT applications, with the aim of connecting 30 billion IoT devices by 2025. eSIM will enable operators to optimize their processes and open up new revenue opportunities. -

Regulatory Support for eSIM Implementation

Governments are increasingly encouraging the use of eSIM technology by favourable legislation. In the European Union, the eSIM has been introduced in order to increase competition between the mobile operators. The goal is to boost the market and thus innovation in mobile communication. -

Enhanced Security Features

eSIMs are equipped with advanced security features to protect the confidentiality of the data and prevent unauthorised access. Companies such as Infineon are developing these security features for eSIMs, which are important for applications in finance and health care. This trend is expected to strengthen the confidence of consumers and thus encourage further take-up in sensitive industries. -

Growth of Mobile Virtual Network Operators (MVNOs)

The emergence of eSIM technology is making it easier for MVNOs to grow. It is enabling them to offer flexible and cost-effective services without the need for physical SIM cards. Observers expect MVNOs to grab a significant share of the mobile market, offering consumers more choice and driving down prices. This development is changing the competitive landscape of the mobile industry. -

Partnerships for eSIM Ecosystem Development

Strategic alliances are being forged between the main players in the eSIM market, with the aim of establishing a complete eSIM system. NTT Docomo has teamed up with a number of device manufacturers to ensure the smooth operation of eSIMs. It is these kinds of strategic alliances that will spur innovation and drive the spread of eSIMs to all industry sectors. -

Shift Towards Remote SIM Provisioning

SIM cards are activated remotely. eSIMs can be activated and managed without the need to go to a shop. This shift is illustrated by the Gemalto NV solution for remote management of eSIM profiles. The operational impact is cost reduction for operators and higher customer satisfaction through increased convenience. -

Integration with 5G Technology

A combination of eSIM and 5G will open up new use cases and new possibilities for connecting. eSIM is used by operators to facilitate 5G services, and studies predict a significant growth in 5G subscriptions in the coming years. This trend will create new business opportunities and new ways of offering services to consumers. -

Focus on Sustainability

The eSIM market is in line with the goal of reducing the e-waste of physical SIM cards. The industry is promoting eSIMs as a greener alternative, and studies show that eSIMs can significantly reduce the carbon footprint of mobile telephony. This is expected to resonate with consumers who are concerned about the environment and drive further uptake. -

Emergence of eSIM in Automotive Industry

The automobile industry is now deploying the eSIM technology for connected cars, which improves navigation and telematics. By 2030, it is expected that the majority of cars on the market will be connected. This trend will change the driving experience and will open up new business opportunities for automobile manufacturers.

Conclusion: Navigating the eSIM Competitive Landscape

In 2022 the eSIM market was a complex tapestry of competitive activity, characterized by significant fragmentation and varied regional trends. The big players reacted to the new situation by promoting their established networks and customer bases, while newcomers based their business models on agile, sustainable and flexible solutions. The vendors operating in this market environment would be able to exploit advanced capabilities such as AI and automation to gain a decisive advantage. These were the companies that could successfully integrate these capabilities into their offerings, thereby gaining a substantial operational efficiency and delivering a superior customer experience. In an increasingly competitive market, this was an essential source of success. Strategic alliances and investments in next-generation capabilities would be the key to success for vendors in this fast-moving market.

Leave a Comment