Esim Size

Market Size Snapshot

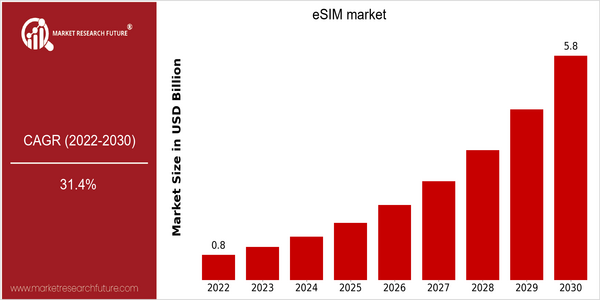

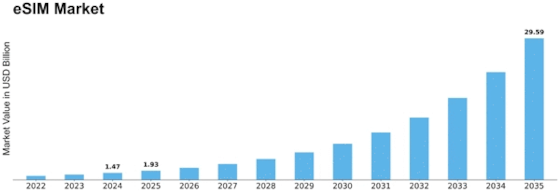

| Year | Value |

|---|---|

| 2022 | USD 0.85 Billion |

| 2030 | USD 5.77 Billion |

| CAGR (2024-2030) | 31.4 % |

Note – Market size depicts the revenue generated over the financial year

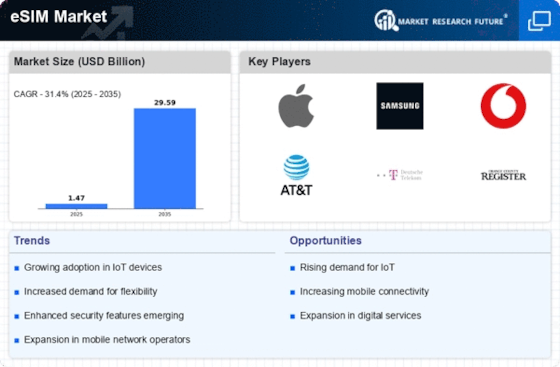

The eSIM market has already been estimated to be worth $ 0.85 billion in 2022 and is expected to be worth $ 5.77 billion in 2030. A CAGR of 31.4% is expected between 2024 and 2030. This growth is driven by a burgeoning demand for eSIM technology in many industries. The escalating demand for IoT devices and the need for seamless and reliable connectivity are two key drivers of this expansion. As digital transformation continues to take hold across industries, eSIMs are becoming an essential element of the connected device and the connected customer experience. The eSIM market is also being pushed forward by the evolution of mobile network technology, the proliferation of smart devices, and the trend towards remote management of mobile services. The major players, such as Apple, Samsung, and Vodafone, are investing heavily in eSIM technology, forging strategic alliances, and launching new products to take advantage of this trend. The integration of eSIMs into the latest models of the iPhone has had a significant effect on the take-up of the technology. These strategic initiatives are likely to play a key role in shaping the future of the eSIM market.

Regional Market Size

Regional Deep Dive

eSIM is a technology that is experiencing significant growth in several regions. It is mainly driven by the growing demand for IoT devices, the need for seamless communication and the digital SIM technology. In North America, Europe, Asia-Pacific, Middle East and Africa, and Latin America, the market is influenced by technological development, regulatory frameworks, and consumers' preferences. Each region has its own opportunities and challenges, varying in terms of readiness and maturity.

Europe

- The European Union has implemented regulations that mandate the interoperability of eSIMs across different networks, fostering a more competitive environment and encouraging innovation among telecom providers.

- Companies like Deutsche Telekom and Vodafone are leading initiatives to integrate eSIM technology into various devices, including wearables and automotive applications, which is expected to enhance user experience and drive market growth.

Asia Pacific

- Countries like Japan and South Korea are at the forefront of eSIM adoption, with major manufacturers such as Samsung and Sony incorporating eSIM technology into their latest devices, thereby setting a trend for the region.

- The Asia-Pacific region is witnessing a surge in IoT applications, particularly in smart cities and connected vehicles, which is driving demand for eSIM solutions that offer greater flexibility and connectivity.

Latin America

- In Brazil, regulatory changes are encouraging telecom operators to adopt eSIM technology, which is expected to enhance competition and improve service offerings for consumers.

- Companies like Claro and Vivo are beginning to roll out eSIM services, focusing on urban areas where demand for advanced mobile solutions is increasing, thus paving the way for broader adoption across the region.

North America

- AT&T and Verizon have both rolled out eSIM to their customers and are enhancing their IoT and flexible tariff offerings. This will have a positive effect on the uptake of eSIMs among consumers and businesses alike.

- The United States Federal Communications Commission (FCC) is working on regulations that would facilitate the introduction of eSIM technology. The FCC is aiming to reduce the number of steps in the device-activation process for consumers and to promote competition among telecommunications service providers.

Middle East And Africa

- Telecom operators in the UAE, such as Etisalat and Du, are launching eSIM services to cater to the growing demand for digital connectivity, particularly among expatriates and tech-savvy consumers.

- The region's unique demographic profile, with a high percentage of mobile users, is creating a fertile ground for eSIM adoption, as consumers seek more convenient and cost-effective mobile solutions.

Did You Know?

“As of 2023, it is estimated that over 1 billion eSIM-enabled devices have been shipped globally, highlighting the rapid adoption of this technology across various sectors.” — GSMA Intelligence

Segmental Market Size

eSIM is a market segment that is experiencing rapid growth. This growth is driven by the increasing demand for connected devices and the need for seamless access to the network. IoT applications, which require a flexible and efficient means of connecting to the network, and the digital transformation of telecommunications, which is promoted by governments, are also driving the growth of eSIM. Furthermore, the preference of consumers for convenience and the possibility of switching operators without the need to change the SIM card are increasing the attractiveness of the market. At present, eSIM technology is at the deployment stage, with the notable exception of the integration of eSIM in the latest models of the iPhone by Apple and the integration of eSIM in the Pixel devices by Google. The regions with the most developed telecommunications systems, such as Europe and North America, lead the way in the deployment of eSIM. The main applications of eSIM are in mobile devices, wearables and in the automobile, whereby automobile manufacturers, such as BMW, have already introduced eSIM for their connected car services. However, the market is also developing in the direction of IoT and the cloud.

Future Outlook

The eSIM market is expected to see a huge growth between 2022 and 2030, with the value of the market set to increase from $852 million to $5.77 billion. This equates to a CAGR of 31.4%. The growth is mainly due to the increase in the number of connected devices, the growth in the number of connected devices in various industries, and the demand for seamless connectivity solutions. The eSIM is expected to be used by about 30% of the world's mobile subscribers by 2030, greatly increasing the convenience and flexibility of mobile services. The development of technology, such as the integration of eSIM in smartphones, wearable devices and automobiles, will also help to drive the market growth. The report also cites the role of regulatory support and the efforts of telecommunication operators to promote eSIM. Also, new trends such as the trend of remote SIM provisioning and the trend of sustainable development of smart terminals will bring new opportunities for the eSIM industry. The report says that as the market develops, companies that can take advantage of these trends and invest in new products will be able to capture the huge market potential.

Leave a Comment