December, 2022: Otis China Adds More Than 100 Digitally Connected Elevators to Tianjin Metro - Otis China has been selected to provide more than 120 escalators and Gen3™ elevators for Tianjin Metro’s new Line 4 northern extension.The new Gen3™ elevators will be connected to Otis ONE™, an Internet of Things (IoT)-based platform already delivering real-time monitoring and predictive maintenance for Tianjin Metro.

The digital ecosystem supports on-site service engineers to provide around-the-clock service to maximize passenger safety and minimize disruption.With 17 stations along a 22-kilometer route, the Line 4 extension builds on a southern section that opened in December 2021 with 186 Otis elevators and escalators.

Overall, the latest addition takes the number of Otis units on the port city’s expanding subway network to more than 1,500.December, 2022: Athens Selects Otis for Nearly 100 Units on Important Metro Line Extension - New contract builds on success of Lines 2 and 3; brings total number of units installed and maintained by Otis to more than 580 - Athens residents and visitors are now able to travel from Venizelos International Airport to the Port of Piraeus in less than an hour on the 47 km Metro Line 3.That line includes six newly opened stations that complete the journey to Piraeus, including 21 Gen2® elevators and 72 heavy-duty Otis escalators.The six new stations are expected to help Piraeus and the greater area meet sustainability and traffic reduction goals – increasing overall passenger traffic on the metro network by 132,000 commuters daily and reducing the need for 23,000 vehicles on the roads above, cutting CO2 emissions by an estimated 60 tons every day.January, 2021: Schindler Launches ElevateMe Mobile App Touchless Elevator OperationThe Schindler ElevateMe smartphone app is part of the new touchless solutions in the Schindler CleanMobility range.

The app allows passengers to simply call the elevator and select the destination with a swipe of a smartphone.Schindler's ElevateMe App is an innovative mobile app that allows passengers to call an elevator and select the destination floor via smartphone, without having to touch any buttons outside or inside the elevator car.With the new ElevateMe app, Schindler offers an end-to-end solution that provides a high level of security, while being easy to activate. Based on Schindler’s Internet of Elevators and Escalators (IoEE) platform, the app works with Schindler Ahead connected elevators.

Installation involves a simple upgrade, after which the service can run instantly. Building owners or managers simply have to place the provided QR code stickers on the elevators and passenger can start operating the elevator via the Schindler ElevateMe app.

Scope of the Escalator Market Report

Type Outlook

Application Outlook

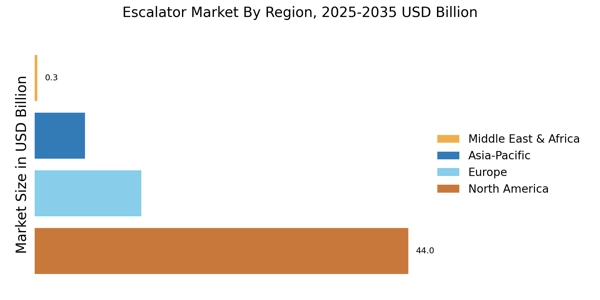

Region Outlook

- Asia-Pacific

- Australia and New Zealand

Objectives of the Study

The objectives of the study are summarized in 5 stages. They are as mentioned below:

Escalator Market Forecast & Size:

To identify and estimate the market size for the escalator market report segmented by type and application by value (in US dollars). Also, to understand the consumption/ demand created by consumers in the escalator market forecast between 2022 and 2030

Market Landscape and Trends:

To identify and infer the drivers, restraints, opportunities, and challenges in the escalator market growth

Market Influencing Factors:

To find out the factors which are affecting the escalator market size among consumers

Impact of COVID-19:

To identify and understand the various factors involved in the market affected by the pandemic

Company Profiling:

To provide a detailed insight into the major companies operating in the market. The profiling will include the financial health of the company in the past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Intended Audience

- Escalator Market manufacturers