Advancements in Veterinary Medicine

The Equine Healthcare Market benefits from continuous advancements in veterinary medicine, which enhance the quality of care available for horses. Innovations such as regenerative therapies, advanced imaging techniques, and minimally invasive surgical procedures are becoming more prevalent. These advancements not only improve treatment outcomes but also increase the efficiency of veterinary practices. As a result, horse owners are more inclined to invest in advanced healthcare solutions for their animals. The market for equine veterinary services is projected to grow, reflecting the increasing reliance on sophisticated medical interventions within the Equine Healthcare Market.

Growing Awareness of Animal Welfare

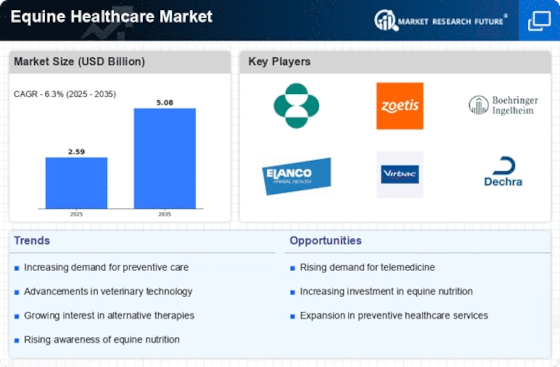

The Equine Healthcare Market is significantly impacted by the growing awareness of animal welfare among horse owners and the general public. This heightened consciousness has led to increased scrutiny of equine care practices, prompting owners to seek out better healthcare solutions for their horses. As a result, there is a marked shift towards preventive care and regular health check-ups, which are essential for maintaining optimal equine health. This trend is expected to drive the demand for veterinary services and health products, thereby fostering growth within the Equine Healthcare Market.

Expansion of Online Veterinary Services

The Equine Healthcare Market is witnessing a transformation due to the expansion of online veterinary services, which provide convenient access to healthcare for horse owners. Telemedicine and online consultations are becoming increasingly popular, allowing owners to seek expert advice without the need for in-person visits. This trend is particularly beneficial for those in remote areas or with limited access to veterinary clinics. The rise of e-commerce platforms for equine health products further complements this shift, making it easier for owners to obtain necessary supplies. As these services continue to evolve, they are likely to enhance the overall accessibility and efficiency of the Equine Healthcare Market.

Rising Participation in Equestrian Sports

The Equine Healthcare Market is positively influenced by the rising participation in equestrian sports, which has led to an increased focus on horse health and performance. As more individuals engage in activities such as show jumping, dressage, and racing, the demand for specialized healthcare services and products rises correspondingly. This trend is evident in the growing number of equestrian events and competitions, which necessitate comprehensive healthcare strategies for participating horses. Consequently, the Equine Healthcare Market is likely to expand as owners prioritize the health and performance of their equine athletes.

Increasing Demand for Equine Health Products

The Equine Healthcare Market experiences a notable surge in demand for health products, driven by a growing awareness of equine health among horse owners. This trend is reflected in the increasing sales of supplements, vaccines, and medications tailored for horses. In recent years, the market for equine supplements alone has expanded significantly, with estimates suggesting a compound annual growth rate of approximately 5.5%. This heightened focus on equine health is likely to continue, as owners seek to enhance the well-being and performance of their horses, thereby propelling the growth of the Equine Healthcare Market.