Technological Innovations

Technological innovations are emerging as a significant driver for the Equatorial Guinea Oil and Gas Downstream Market. The adoption of advanced refining technologies and digital solutions is expected to enhance operational efficiency and reduce costs. For instance, the implementation of automation and data analytics in refining processes can lead to improved yield and reduced downtime. Additionally, innovations in logistics and supply chain management can optimize distribution networks, ensuring timely delivery of products to consumers. As the industry evolves, companies that invest in cutting-edge technologies may gain a competitive edge, positioning themselves favorably in the market. This trend towards modernization is likely to attract further investments, thereby stimulating growth in the downstream sector.

Increasing Domestic Demand

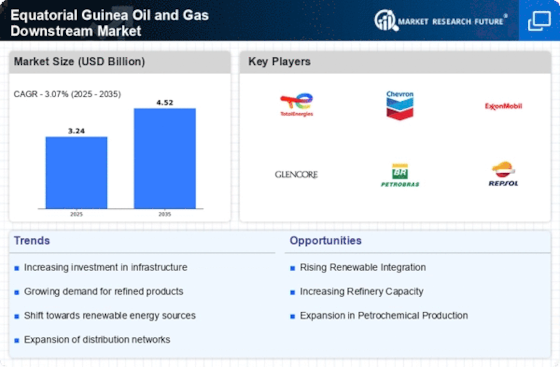

The rising domestic demand for refined petroleum products in Equatorial Guinea is a pivotal driver for the Equatorial Guinea Oil and Gas Downstream Market. As the population grows and urbanization accelerates, the need for fuels such as gasoline, diesel, and kerosene is expected to increase. In 2025, the demand for refined products is projected to reach approximately 1.5 million tons, reflecting a compound annual growth rate of around 3.5%. This surge in consumption is likely to stimulate investments in refining capacity and distribution infrastructure, thereby enhancing the overall market landscape. Furthermore, the government’s initiatives to promote local consumption of oil products may further bolster this trend, creating a more robust downstream sector.

Regional Market Integration

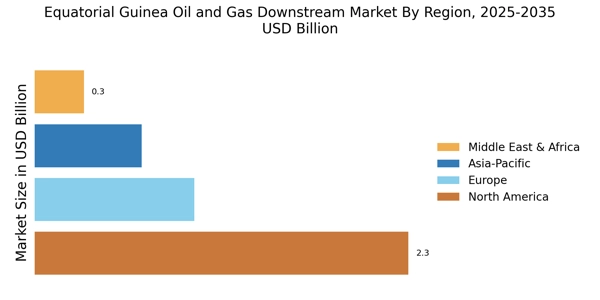

Regional market integration is becoming increasingly relevant for the Equatorial Guinea Oil and Gas Downstream Market. The country is strategically located within the Central African region, which presents opportunities for cross-border trade and collaboration. Efforts to harmonize regulations and standards among neighboring countries could facilitate the movement of refined products, enhancing market access for local producers. Additionally, regional partnerships may lead to shared investments in infrastructure, such as pipelines and storage facilities, which can lower operational costs. As Equatorial Guinea seeks to position itself as a key player in the regional energy landscape, such integration may bolster the downstream market, creating a more interconnected and resilient industry.

Regulatory Framework Enhancements

Enhancements in the regulatory framework governing the oil and gas sector are likely to influence the Equatorial Guinea Oil and Gas Downstream Market positively. The government has been working on refining policies to create a more conducive environment for investment and operational efficiency. Recent reforms include streamlining licensing processes and improving transparency in regulatory practices. These changes may attract both local and international players to the downstream market, fostering competition and innovation. Furthermore, a robust regulatory framework can ensure compliance with environmental standards, which is increasingly becoming a priority for stakeholders. As a result, the industry may witness a more sustainable approach to operations, aligning with global best practices.

Investment in Infrastructure Development

Investment in infrastructure development is crucial for the growth of the Equatorial Guinea Oil and Gas Downstream Market. The government has recognized the need for modernizing and expanding existing facilities, including refineries and distribution networks. Recent reports indicate that the country aims to increase its refining capacity from 30,000 barrels per day to 60,000 barrels per day by 2027. This expansion is expected to attract foreign direct investment, which could enhance technological capabilities and operational efficiencies. Additionally, improved infrastructure will facilitate better access to markets, thereby increasing the competitiveness of local products against imports. Such developments may also lead to job creation and economic diversification, further solidifying the downstream sector's role in the national economy.