Growing Awareness of Omega-3 Benefits

The benefits of epa and dha Omega-3 ingredients are becoming more widely recognized, contributing to their growing popularity in the market. Research indicates that these fatty acids play a crucial role in reducing inflammation, improving heart health, and enhancing brain function. As scientific studies continue to validate these health claims, consumers are more inclined to incorporate EPA and DHA Omega-3 ingredients into their diets. The EPA and DHA Omega-3 Ingredient Market is responding to this trend by developing innovative products that highlight these benefits, such as omega-3 fortified foods and dietary supplements. This increased awareness is not only driving sales but also encouraging manufacturers to invest in marketing strategies that educate consumers about the advantages of omega-3 consumption. Consequently, the market is likely to expand as more individuals seek to improve their health through the inclusion of these essential nutrients.

Regulatory Support for Omega-3 Products

Regulatory bodies are increasingly recognizing the importance of EPA and DHA Omega-3 ingredients, leading to supportive policies that facilitate market growth. Governments are promoting the consumption of omega-3 fatty acids due to their health benefits, which has resulted in favorable regulations for manufacturers. This support is evident in various countries where guidelines encourage the fortification of food products with EPA and DHA Omega-3 ingredients. The EPA and DHA Omega-3 Ingredient Market benefits from this regulatory environment, as it fosters innovation and encourages companies to develop new products that meet consumer demand. Additionally, the establishment of safety and quality standards enhances consumer trust, further driving market expansion. As regulations continue to evolve, the market is expected to witness increased investment and product development, ultimately benefiting consumers seeking high-quality omega-3 options.

Increasing Demand for Nutritional Supplements

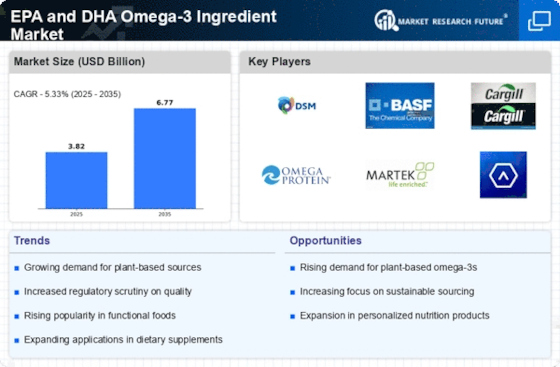

The rising awareness regarding health and wellness has led to an increasing demand for nutritional supplements, particularly those containing EPA and DHA Omega-3 ingredients. Consumers are becoming more proactive about their health, seeking products that support cardiovascular health, cognitive function, and overall well-being. The EPA and DHA Omega-3 Ingredient Market is experiencing a notable surge, with the market projected to reach USD 5 billion by 2026. This growth is driven by the aging population and the prevalence of chronic diseases, which has prompted individuals to seek preventive health measures. Furthermore, the incorporation of these ingredients into various products, such as functional foods and beverages, is expanding the market reach, appealing to a broader audience. As consumers increasingly prioritize health, the demand for EPA and DHA Omega-3 ingredients is likely to continue its upward trajectory.

Technological Innovations in Omega-3 Production

Technological advancements in the extraction and production of EPA and DHA Omega-3 ingredients are transforming the market landscape. Innovations such as supercritical CO2 extraction and enzymatic processing are enhancing the efficiency and purity of omega-3 products. These technologies not only improve yield but also ensure that the final products retain their nutritional integrity. The EPA and DHA Omega-3 Ingredient Market is witnessing a shift towards more sustainable production methods, which appeal to environmentally conscious consumers. As manufacturers adopt these cutting-edge technologies, they are better positioned to meet the growing demand for high-quality omega-3 ingredients. This focus on innovation is likely to drive competition within the market, leading to a wider array of products and potentially lower prices for consumers.

Rising Popularity of Plant-Based Omega-3 Sources

The trend towards plant-based diets is influencing the EPA and DHA Omega-3 Ingredient Market, as consumers seek alternative sources of omega-3 fatty acids. Algal oil, a plant-based source of EPA and DHA, is gaining traction among vegetarians and vegans who are looking for sustainable and ethical options. This shift is prompting manufacturers to explore innovative extraction methods and product formulations that cater to this demographic. The market for plant-based omega-3 ingredients is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. As more consumers adopt plant-based lifestyles, the demand for EPA and DHA Omega-3 ingredients derived from algae is likely to increase, driving market diversification and expansion.