Market Trends

Key Emerging Trends in the Enterprise Data Integration Market

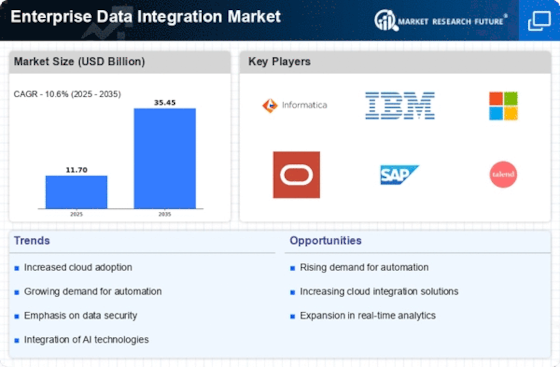

The enterprise data integration market is experiencing notable trends, reflecting the dynamic landscape of data management and the increasing importance of seamless information flow across organizations. As businesses continue to amass vast amounts of data from diverse sources, the demand for efficient and scalable data integration solutions has surged, leading to several key trends in this market.

One significant trend is the adoption of cloud-based data integration solutions. Organizations are increasingly leveraging cloud infrastructure for its scalability, flexibility, and cost-effectiveness. Cloud-based data integration platforms allow businesses to integrate data from on-premises and cloud sources, providing a unified view of information. This trend aligns with the broader industry shift towards cloud computing, reflecting a preference for solutions that support the evolving needs of modern, digitally transformed enterprises.

Moreover, the rise of real-time data integration is reshaping the landscape. Traditional batch processing methods are giving way to real-time or near-real-time data integration, driven by the need for timely and actionable insights. Businesses are adopting solutions that enable continuous data streaming and processing, allowing them to make informed decisions based on the latest information. This trend is particularly crucial in industries such as finance, e-commerce, and healthcare, where up-to-the-minute data can significantly impact decision-making.

Another key trend is the increasing adoption of artificial intelligence (AI) and machine learning (ML) in data integration processes. AI and ML algorithms are being employed to automate data mapping, cleansing, and transformation tasks, reducing the manual effort required for integration. This trend enhances efficiency, reduces errors, and accelerates the time-to-insight. Organizations are embracing smart data integration solutions that leverage these technologies to handle the complexity and diversity of modern data landscapes.

The market is also witnessing a focus on self-service data integration tools. As data integration becomes a critical function across various business units, organizations are empowering non-technical users to perform data integration tasks. Self-service data integration tools allow business users to connect and transform data without extensive IT intervention, fostering agility and enabling faster decision-making. This trend aligns with the broader movement towards democratizing data access and analytics within organizations.

Furthermore, there is an emphasis on hybrid and multi-cloud data integration. With organizations operating in multi-cloud environments and maintaining a mix of on-premises and cloud-based systems, the need for seamless data integration across these environments is paramount. Solutions that support hybrid and multi-cloud scenarios enable businesses to maintain flexibility and agility in their data management strategies. This trend reflects the reality of the modern IT landscape, where enterprises leverage a combination of on-premises and cloud resources.

Additionally, the importance of data governance in data integration is gaining prominence. As data privacy regulations and compliance requirements become more stringent, organizations are recognizing the need for robust data governance practices within their data integration processes. Solutions that incorporate data quality, lineage tracking, and metadata management contribute to ensuring data integrity and compliance. This trend underscores the critical role of data governance in maintaining the trustworthiness of integrated data.

Moreover, organizations are increasingly looking towards containerization and microservices architectures in data integration. Containerization provides a lightweight, scalable, and portable environment for deploying and managing data integration processes. Microservices architectures enable the decomposition of complex integration tasks into modular, independently deployable services. This trend reflects the industry's pursuit of agility, scalability, and resilience in data integration solutions.

Leave a Comment