Engineered Plastics Size

Engineered Plastics Market Growth Projections and Opportunities

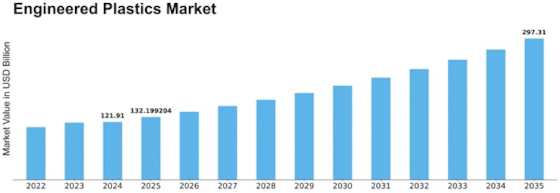

The Market Size of what is called Engineered Plastics amounted to $ 101.3 billion in 2022. From the previous year's figures, the Engineered Plastics market industry is expected to increase up to $233.06 billion by 2032 at a CAGR of 9.70%. A number of factors are responsible for influencing the dynamics and growth trajectory of the engineered plastics market, as mentioned below. One of the main driving forces behind it, though, is its demand from many industries that need lightweight and high-performance materials. The exceptional strength-to-weight ratio possessed by engineered plastics makes them widely used in the automotive, aerospace, and electronics sectors. As these industries develop further, there is a growing need for advanced materials that will improve efficiency and fuel economy, which requires engineered plastics. Again, environmental focus on global sustainability has become one of the key drivers of this market's development. Engineered plastics are increasingly being used as alternatives to traditional materials due to their recyclable nature and eco-friendliness. Environmental issues have led manufacturers to use environmentally friendly products; thus, they prefer using these types of materials, too. Particularly important are developments in the automotive industry whereby players' targets entail improving fuel efficiency through reducing vehicle weight while complying with increasingly stringent emissions standards, resulting in increased consumption rates for lightweight materials such as engineered plastics since they possess an optimal combination of toughness and density thereby ensuring a balance between car performance as well as safety. Therefore driven. Additionally, technological advancement and material innovations have influenced this sector greatly. Technological advancements, along with new formulations and improved properties, result from continued research and development activities currently undertaken on engineered plastics. Global economic factors also influence the Engineered Plastics Market. The growth trends within this industry tend to be influenced mainly by industrial activities, infrastructural development, and consumer spending. Economic stability & overall economic growth create favorable conditions for investment inflow into such sectors as electronics-construction-automotive, where the demand pool for such materials as engineered plastics is constantly increasing. Market competition and regulatory frameworks also influence the Engineered Plastics Market. High product safety and environmental impact regulations enforce high-quality and compliant products during production.

Leave a Comment