Advancements in Material Science

Innovations in material science are playing a crucial role in shaping the Engineered Fluids Market. The development of new synthetic fluids with enhanced properties, such as improved thermal stability and lower viscosity, is enabling better performance in various applications. These advancements allow for the creation of fluids that can withstand extreme temperatures and pressures, thereby expanding their usability across different sectors. The introduction of bio-based engineered fluids is also gaining traction, appealing to environmentally conscious consumers. As these materials continue to evolve, they are expected to drive growth in the Engineered Fluids Market, as manufacturers seek to leverage these innovations for competitive advantage.

Increasing Industrial Automation

The trend towards industrial automation is significantly impacting the Engineered Fluids Market. As industries adopt automated systems, the need for reliable and efficient fluids that can operate in high-performance environments is becoming more pronounced. Engineered fluids are essential in hydraulic systems, lubrication, and cooling applications, where precision and reliability are paramount. The automation of manufacturing processes is projected to increase the demand for engineered fluids, as companies seek to enhance productivity and reduce downtime. This shift is likely to create new opportunities within the Engineered Fluids Market, as suppliers adapt their offerings to meet the evolving needs of automated systems.

Growth in Renewable Energy Sector

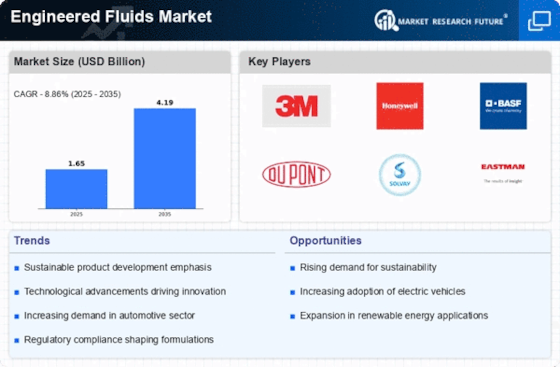

The Engineered Fluids Market is significantly influenced by the expansion of the renewable energy sector. As countries strive to meet their renewable energy targets, the demand for specialized fluids that can operate efficiently in solar thermal systems and wind energy applications is increasing. For example, heat transfer fluids used in solar power plants are essential for maximizing energy capture and conversion. The market for these fluids is projected to grow at a compound annual growth rate of over 10% in the coming years. This growth is indicative of the broader shift towards sustainable energy solutions, which is likely to further stimulate the Engineered Fluids Market.

Rising Demand for Energy Efficiency

The Engineered Fluids Market is experiencing a notable increase in demand for energy-efficient solutions. Industries are increasingly adopting engineered fluids that enhance thermal management and reduce energy consumption. For instance, the use of advanced heat transfer fluids can lead to energy savings of up to 30% in various applications. This trend is driven by regulatory pressures and the need for sustainable practices, prompting manufacturers to innovate and develop fluids that meet these criteria. As energy costs continue to rise, the focus on energy efficiency is likely to propel the Engineered Fluids Market forward, with companies investing in research and development to create more effective solutions.

Regulatory Compliance and Safety Standards

The Engineered Fluids Market is also being driven by stringent regulatory compliance and safety standards. Industries are required to adhere to various environmental regulations, which necessitate the use of fluids that are not only effective but also safe for both users and the environment. This has led to an increased focus on developing engineered fluids that meet these regulatory requirements, such as low toxicity and biodegradability. Companies that can provide compliant solutions are likely to gain a competitive edge in the market. As regulations continue to evolve, the Engineered Fluids Market is expected to adapt, fostering innovation and the development of safer, more sustainable fluid options.